There were 1,034 mergers and acquisitions among insurance agents and brokers in 2022, up 30% in contrast to 2022, based on Optis Partners LLC.

Well-funded investors continue to be drawn to the sector, and brokerage owners take advantage of high valuations for his or her companies while capital gains tax minute rates are low, the Chicago-based investment banking and financial consultancy said in a report released Tuesday.

“If 2022 was a boom year for mergers and acquisitions, 2022 was a virtual explosion,” Steve Germundson, partner at Optis Partners, said in a statement.

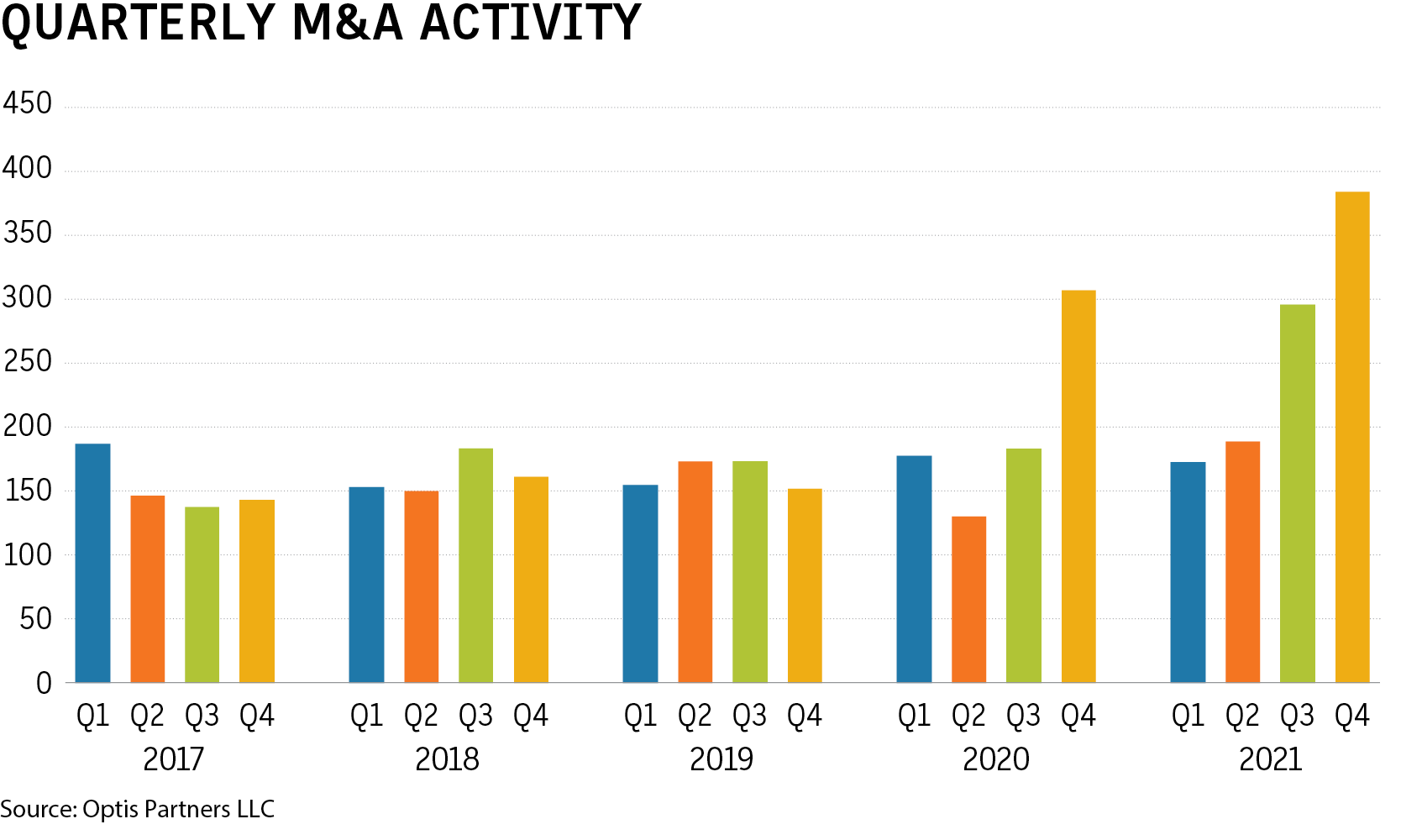

In your fourth quarter, 384 M&A deals involving U.S. and Canadian brokers and agents were announced, a 26% increase within the same period in 2022 along with a 32% increase within the third quarter.

“The fourth quarter rush to close deals by year-end clearly taxed the sellers' deal teams, a lawyer and due-diligence providers. We expect a bit of a first-quarter respite before the cycle accumulates again,” Mr. Germundson said.

Grand Rapids, Michigan-based Acrisure LLC was again probably the most active buyer, with 122 transactions in 2022, as well as the very first time in several years another buyer, Woodlands Hills, California-based PCF Insurance Services LLC, came close with 99 transactions completed. Chicago-based Hub International Ltd. was the 3rd most active buyer with 61 acquisitions, accompanied by Traverse City, Michigan-based High Street Insurance Partners Inc. with 56 and Lake Mary, Florida-based AssuredPartners Inc. with 51.

Private equity-backed buyers and buyers with substantial outside financial support again dominated brokerage M&As with 2022, accounting for 76% of total deals.