Looking to find the best individual medical health insurance options in Dallas to make use of by having an ICHRA? You’re in the right place – and there’s good news! The person coverage HRA (ICHRA for short) is taking off where you reside, thanks to a vibrant local individual medical health insurance market. Which means more ACA-compliant, high quality health insurance choices for employees.

| We’ve put together this guide to assist employees orient themselves to the local individual health insurance market in Dallas to make use of with their Individual Coverage HRA. Health insurance can be confusing, and many employees offered an ICHRA will be buying their insurance the very first time. We’ve got you covered! |

Who this informative guide is for:

- Employees looking for health insurance to make use of using their ICHRA

- Employers wanting to help their employees make educated decisions about their health intends to use using their ICHRA

- Employers associated with a size considering implementing an ICHRA

What this guides covers:

What is an ICHRA?

First things first. An Individual Coverage HRA (ICHRA, for brief) is a fundamentally new model of benefits that allows employers to create aside tax-free dollars to reimburse employees for health plan premiums that folks choose themselves. Which means employees get to select the right arrange for their family, their unique health needs, as well as their budget.

2022 Dallas individual medical health insurance options for ICHRA

The individual coverage HRA is thriving in Dallas, thanks to a cutting-edge carrier lineup and affordable options for quality care.

This develops an ongoing trend, signaling the and affordability of the baby medical health insurance market. More and more employers in Dallas are realizing their benefits dollars stretch further around the individual medical health insurance market rather than group plans, and this brings ample employee benefits too, like personalization and selection.

Disclaimer: These rates are estimates for Dallas in 2022 in the 75217 zipcode. Your premiums may vary and that we expect slight changes for 2022. See our window shopping tool to check for exact premium rates in your town.

Market Snapshot

Dallas’ competitive individual health insurance market and innovative carrier lineup mean more selections for employees. The infographic below demonstrates the number of carriers, network types, and average cheapest premiums by tier.

Pro-tip: To calculate costs for adding a spouse or family to some plan, use double the amount rate for married, or triple for families.

The individual medical health insurance market in Dallas boasts eight carriers with more than 100 plans for workers to select from.

.png?width=595&name=Dallas-%20Market%20Snapshot%20(1).png)

Disclaimer: Plan information is according to 75217, the most populated zip code in Dallas. Rates will vary by zip code and county.

Remember, all the plans listed here are ACA-compliant, meaning they cover pre-existing conditions and 10 essential benefits. These benefits include coverage with no annual cap for the following:

- Ambulatory patient services (outpatient services)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services, including behavioral health treatment

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care

Have questions? Get in contact.Employees: If you are an employee looking to subscribe to individual health insurance in Dallas to make use of together with your ICHRA, our enrollment team is standing around the ready to help. You can set up a call with enrollment team here. Business owners: If you’re a business owner and have questions regarding ICHRA, please schedule a period to talk with this HRA Design team to find out if ICHRA is a great fit for you. Brokers: If you’re an agent considering ICHRA being an choice for a client, submit an HRA Design request to see if this is an excellent fit for your client. |

The lineup: Dallas’ best individual health insurance carriers to make use of with ICHRA

Dallas, Texas now has 8 medical health insurance carriers to choose from.

These include (from a to z):

- Ambetter

- BlueCross BlueShield of Texas

- Bright Healthcare (new for 2022!)

- Friday Health Plans

- Molina

- Oscar

- Scott and White

- UnitedHealthcare (new for 2022!)

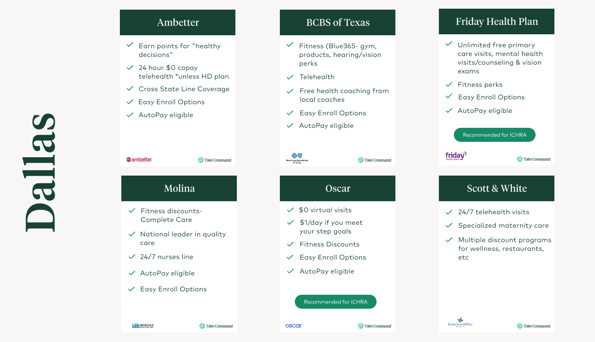

Here’s a Dallas medical health insurance infographic for a quick visual.

| Ambetter | BlueCross BlueShield of Texas | Bright Healthcare | Friday Health Plans | Molina | Oscar | Scott and White | United Healthcare | |

| Recommended for ICHRA | ||||||||

| Easy Enroll options | ||||||||

| AutoPay eligible | ||||||||

| Off-exchange options |

*Autopay is a new feature on our platform that allows employers to take benefit of ICHRA and all its benefits without asking their employees to pay premiums up front and wait for reimbursements.

One simple payment per month that covers all of the reimbursements for insurance premiums (and medical expenses) for all employees. Our platform will manage the instalments for employees’ health benefits, reconciling their premiums and allowance with payroll. Learn more here.

*Easy Enroll is a plan feature that allows employees on the Take Command platform to enroll directly in the portal without any further steps needed. This is actually the simplest kind of plan to choose.

*Off-exchange options are important for employees that choose a plan which costs a lot more than their allowance, since they’ll have to place in a few of their own money to pay for the difference. That difference can be tax-free when combined with a Section 125 payroll deduction but only for off-exchange plans (due to some ACA restrictions).

Here’s another handy infographic which includes a lot of our favorite things about every individual medical health insurance carrier in Dallas.

How much does individual health insurance cost in Dallas per carrier?

The below minute rates are 2022 estimates according to Dallas zip code 75217 only. We'll update this section as new details are released for 2022.

What we love:

- 24-hour, $0 telehealth

- Gym discounts, eating healthily discounts (Home Chef)

- Healthy Decision points that can be used for various benefits

- Easy Enroll options

- AutoPay eligible

What we don’t love:

- Frustrating customer service

Lowest cost by metal tier for Ambetter in Dallas

| Age | Bronze | Silver | Gold |

| 20 | $290 | $250 | $330 |

| 30 | $350 | $300 | $390 |

| 40 | $390 | $340 | $440 |

| 50 | $540 | $470 | $610 |

| 60 | $820 | $710 | $920 |

What we love:

- Blue365 program with gym, products, hearing and vision perks

- Telehealth includes behavioral and mental wellness visits

- Free health coaching with local coaches

- Easy Enroll options

- AutoPay eligible

Lowest cost by metal tier for BlueCross BlueShield of Texas in Dallas

|

Age |

Bronze | Silver | Gold |

| 20 | $230 | $300 | $310 |

| 30 | $270 | $360 | $360 |

| 40 | $300 | $400 | $400 |

| 50 | $420 | $560 | $570 |

| 60 | $650 | $850 | $860 |

What we like:

- Easy enroll options

- Autopay eligible

- Visits towards the MinuteClinic or The Little Clinic are simply $25 or less of all plans

- $0 mental health choices on most plans

- Adult dental and vision options

- Recommended for ICHRA

Lowest cost by metal tier for Bright Healthcare in Dallas for 2022

| Age | Bronze | Silver | Gold |

| 20 | $220 | $250 | $290 |

| 30 | $250 | $290 | $340 |

| 40 | $280 | $320 | $380 |

| 50 | $400 | $450 | $540 |

| 60 | $600 | $690 | $820 |

What we like:

- Unlimited in-network $0 doctor visits and virtual doctor visits of all plans

- Free mental health visits

- Easy Enroll options

- AutoPay eligible

- Recommended for ICHRA

Lowest cost by metal tier for Friday Health Plans in Dallas

|

Age |

Bronze | Silver | Gold |

| 20 | $210 | $320 | $300 |

| 30 | $240 | $370 | $350 |

| 40 | $270 | $420 | $390 |

| 50 | $380 | $580 | $550 |

| 60 | $580 | $890 | $840 |

What we like:

- Fitness discounts; Complete Care covers gym memberships 100%

- 24/7 Nurses Line available to all members

- Easy Enroll options

- AutoPay eligible

Lowest cost by metal tier for Molina in Dallas

|

Age |

Bronze | Silver | Gold |

| 20 | $230 | $320 | $340 |

| 30 | $270 | $370 | $400 |

| 40 | $300 | $420 | $450 |

| 50 | $420 | $590 | $630 |

| 60 | $630 | $890 | $970 |

What we love:

- Talk to a doctor 24/7 for $0

- Free telehealth

- $1/day when you reach your step goals (up to $100)

- Prescription refills within the phone

- Great customer service

- AutoPay eligible

- Easy Enroll options

- Recommended for ICHRA

Lowest cost by metal tier for Oscar in Dallas

|

Age |

Bronze | Silver | Gold |

| 20 | $260 | $290 | $380 |

| 30 | $300 | $340 | $440 |

| 40 | $340 | $380 | $500 |

| 50 | $470 | $530 | $690 |

| 60 | $720 | $800 | $1,050 |

What we love:

- 24/7 telehealth visits

- Highly specialized maternity programs

- Multiple discount programs for wellness, restaurants, etc.

Lowest cost by metal tier for Scott & White in Dallas

|

Age |

Bronze | Silver | Gold |

| 20 | $300 | $350 | $370 |

| 30 | $350 | $410 | $440 |

| 40 | $400 | $470 | $490 |

| 50 | $550 | $650 | $690 |

| 60 | $840 | $990 | $1,050 |

What we love:

- Access to “Rally”, a website and app that can help you learn simple ways to look after yourself.

Lowest cost by metal tier for United Healthcare in Dallas for 2022

| Age | Bronze | Silver | Gold |

| 20 | $240 | $330 | $330 |

| 30 | $280 | $380 | $390 |

| 40 | $310 | $430 | $430 |

| 50 | $430 | $600 | $610 |

| 60 | $660 | $910 | $920 |

For rates in your town according to how old you are, family size, along with other variables, take a look at our window shopping tool!

What health plans have been in network with your hospitals in Dallas?

| Ambetter | BlueCross BlueShield of Texas | Bright Healthcare | Friday Health Plans | Molina | Oscar | Scott and White | United Healthcare | |

| Baylor Scott and White Health | ||||||||

| Children’s Health (Children’s Clinic) | ||||||||

| HCA Healthcare (Medical City) | ||||||||

| Methodist Health System | ||||||||

| Parkland Health insurance and Hospital System | ||||||||

| University of Texas Health System (UT Southwestern) |

Disclaimer: Networks and plans can change year over year. We keep this information as current as you possibly can, but please check with your provider to ensure your insurance is accepted.

How do I choose the best individual insurance policy for me?

One in our favorite reasons for ICHRA is it allows employees to find the best plan for them, instead of a one-size-fits-all group plan where they only have one or two options. At Take Command, we have tools to help employees sort through the options.

- Doctor search: Check out our doctor search tool to ensure that your trusted doctors stay in network with your new health plan. Try out our window shopping tool and search for plans that actually work with your doctors!

- Prescription search: Prescriptions is yet another big expense! Different carriers cover them differently, therefore it is important to price check and take a best of luck at formularies for all of your health plan options, particularly if there's something you are taking regularly to manage chronic conditions. Our new prescription search tool enables you to compare plan coverage and formularies side by side to get the best coverage at the lowest cost for you. Take a look here.

- Be informed! We’ve put together an Open Enrollment Guide which will give you our best tips and tricks.

To get started looking for a plan, head on over to our individual health insurance shopping page to check plans side by side and find one which is useful for both you and your HRA.

How Take Command can help

With an abundance of quality medical health insurance plans for workers to choose from throughout the state, Dallas workers are positioned for achievement when it comes to satisfaction using their ICHRA.

- Employees: If you are an employee seeking to sign up for individual health insurance in Dallas to make use of with your ICHRA, our enrollment team is standing at the ready to help. You are able to set up a call with enrollment team here.

- Business owners: If you’re an entrepreneur and also have questions about ICHRA, please schedule a time to chat with our HRA Design team to ascertain if ICHRA is a great fit for you.

- Brokers: If you’re an agent considering ICHRA as an choice for a customer, submit an HRA Design request to ascertain if this is a good fit for your client.

Other questions? Email support@takecommandhealth.com or talk to us on the website. We’d be very happy to help!

Source link