The Economic Injury Disaster Loan program with the SBA is a long-standing program intended to help businesses hurt by tornados or wildfires. Following the national disaster was declared in March 2022, funds became open to help small businesses influenced by the pandemic. As part of the CARES (Coronavirus Aid Relief and Economic Security) Act, the Federal government gave the EIDL program a boost, including $10 billion for $10,000 advances/grants given to smaller businesses influenced by the Coronavirus pandemic. These money is separate from the Payroll Protection Program, both of which saw an influx of applicants in the past fourteen days but operate as additional avenues to find financial assistance.

For other resources related to small company and the coronavirus, take a look at our COVID-hub updated with information.

How Long Is The EIDL Funding Timeline?

After trying to get an EIDL, most applicants will get a funding decision within 21 days. If approved, disbursements are typically made within a week. However, remember that the EIDL approval timeline can differ based on how many applications the SBA is processing.

EIDL Funding Timeline: From Application To Account Deposit

Need to understand each part of the EIDL funding timeline? Listed here are the various sections (application, approval, processing, and deposit) from the process and what you can expect.

EIDL Application

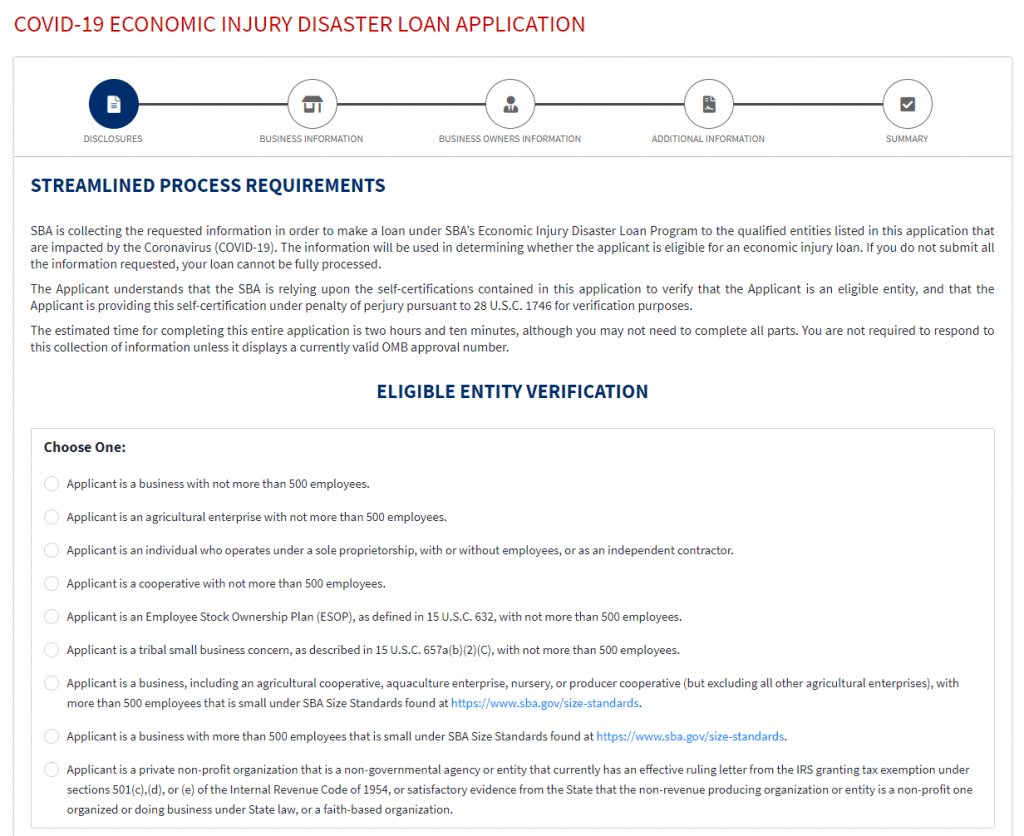

Depending how many details you've ready, the EIDL application shouldn’t get you more than one hour. The SBA You can apply online directly with the SBA’s website. The application consists of a screening page, a business information page, a business owner page, a page to acquire more information, along with a summary.

If you want the process to go quickly, be sure you have your tax information handy.

Application Approval

This may be the part that eats up the most time. The methods of the SBA are mysterious indeed, but anything they do takes around 21 days. Unfortunately, there’s not really a good deal that you can do here other than check on the status of your EIDL application.

Processing & Account Deposit

The SBA language states that whenever approval, funds should appear within 5 days. Many businesses experienced longer waits within the program’s last phase, however.

As we aren’t far enough out from the start of the new round of funding, it’s unclear whether things are running nearer to schedule this time around.

How Long Will It Decide to try Get The Targeted EIDL Grant?

In 2022, it was easy to get a portion of your EIDL loan as an emergency advance grant. That’s no longer the case. Instead, the SBA is rolling out a targeted EIDL grant targeted at businesses in low-income areas which have a break down revenue loss because of COVID. In short, you might be eligible for a a targeted EIDL grant if:

- You previously applied for an EIDL Grant but didn’t get the full $10,000.

- Your business is situated in a low-income community.

- You can demonstrate a 30% loss of income due to the COVID pandemic.

This will rule out a large number of small businesses that qualify for an EIDL loan.

So, for those who do qualify, how long does it take to get a targeted EIDL grant? That depends on the few different factors as the SBA is taking an unusual method of processing these grants. As of at this time, you can’t actually apply for Targeted EIDL grants whatsoever.

So what's happening? On February 1, 2022, the SBA started sending out email invitations to companies that received EIDL Advances (the prior iteration) in amounts under $10,000. There’s not sure yet on if the program is going to be opened further following the high-priority groups are served.

If you do receive an email invitation in the SBA, the timeline to fulfillment is similar to that of the EIDL loans. The SBA estimates that it'll take around 21 days to process your case.

Disaster Loan Funding Timeline: Final Thoughts

The COVID-19 pandemic has been an unprecedented economic disaster affecting many industries, smaller businesses, and workers. EIDL loans, along with the PPP, are the biggest lifelines around for many smaller businesses. No one wants to listen to they have to wait for life preserver when they’re drowning. As SBA programs go, EIDL loans are blazing fast, but you’re still taking a look at a wait duration of 3 to 4 weeks an email psychic reading relief. Unfortunately, the only real area of the process you really have any treatments for may be the application, which you can accelerate by having documents and knowledge handy when you’re filling it out. Still, that only accounts for hours, not days.

Not sure the EIDL loan is the best remedy for your COVID slump?

The PPP operates just a little differently and perhaps a much better fit for your circumstances. If you operate a live venue and also have suffered economic damages associated with COVID, you may even want to consider a Shuttered Venue Operator Grant. This is a new program that offers large, 100% debt-free grants to qualifying businesses. The qualifications are pretty strict, however, so make certain you’re eligible before you decide to apply.

If I'd $ 1 for every time I just read “unprecedented times” in an article or a Facebook status, I’d be treating myself to an inflatable spa in my quarantine days. But the phrase is ubiquitous because it’s a quick method to state the extraordinariness and confusion of the past year. As a company that prides itself on helpfulness, it’s difficult when there are plenty of question marks littering the landscape.

In this particular situation, it’s better to be equipped with documents and then be prepared to wait. In the meantime, you can also research and appearance into other lending options. How has your experience been using the EIDL process? Tell us within the comments.