In 2022, the SBA added a well known grant aspect of their Economic Injury Disaster Loan (EIDL) program as a response to the COVID-19. That program had exhausted the $20 billion allocated for this by summer 2022 — but now it’s back. The stimulus bundle passed December 21, 2022, re-funded the EIDL program to the tune of $40 billion.

There are a few catches, however.

One of the biggest changes to the EIDL grant program may be the requirement that the business needs to be located inside a low income community.

While you might have a vague sense of the economical values for the city or region, it’s easy to over – or underestimate the average household salary of your immediate area. Knowing whether or not you’re entitled to an EIDL grant could save you some labor and potential difficulties with the SBA and IRS in the future.

What Is really a Low Income Community?

Community is one of those words that seems like we have an obvious meaning, but in practice often means lot of different things. When it comes to qualifying to have an EIDL grant, what the SBA is talking about is the census tract. For the way populated your area is, there might be many census tracts in your municipality or very few. As it turns out, there are slightly different measures for companies that are located in rural areas as opposed to metropolitan ones.

Now that we know what your community is, let’s check out what’s considered low income by the language in the grant program.

First, the easy metric. In case your community includes a poverty rate of 20% or more, it’s a low income community.

The other way to qualify as low income is relative to your state (if you’re in a more rural area) or the rest of your metropolitan area. So for rural businesses, in case your community’s median family earnings are 80% or less of the statewide median income, you’re considered a low income community. For suburban and concrete businesses, you’ll be considered low-income if the median family income for the community is 80% or less of your metropolitan area’s median family income. This provision allows communities which may be “high-earning” in accordance with the nation's metric, but who live in poor parts of expensive areas to still qualify.

How To inform If You’re In A Low-Income Community

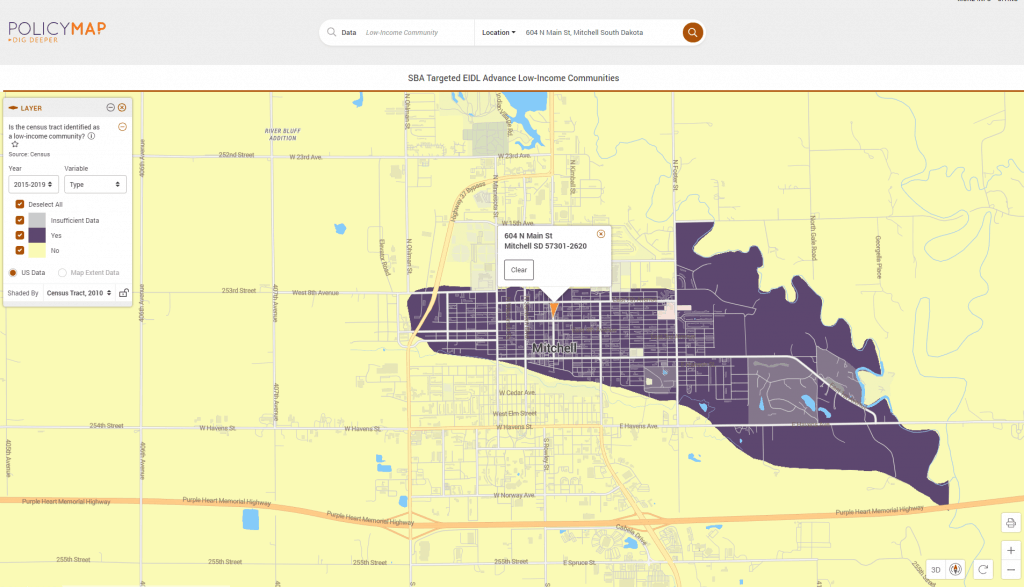

You can use the SBA’s policy map.

So let’s say you take that Corn Palace in Mitchell, South Dakota.

After putting in the Corn Palace’s address, we find that the SBA considers it to fall within a low-income community. Were it a bit farther north or south, however, it wouldn't. Coincidentally, as an active venue, however, they may qualify for a shuttered venue grant.

Other EIDL Grant Requirements

Even if your business is located in a minimal income community, there are a few more qualifications you’ll have to meet before you can get one.

First, your business must employ a more 300 people.

Second, your business needs to have a break down lack of revenue of at least 30%. To determine this, you are taking an eight-week period between March 2, 2022 and December 31, 2022 and compare it to some comparable eight-week period in 2022.

You’ll also need to be in an industry eligible for EIDL assistance. Including many agricultural enterprises, religious and government-owned concerns, businesses considered hobbies, companies that get more than the usual third of the gross revenue from legal gambling activities, and speculative property.

Where To try to get The EIDL Grant

If you think you be eligible for a an EIDL grant, the only thing left to do is apply. Unlike the PPP, EIDL grants and loans are directly administered by the SBA. As of this update, the SBA isn't yet taking applications for EIDL grants, but keep the eyes on their own COVID-19 EIDL application page for when it opens.