More often than not, the economical system is kind of a slow-moving ocean liner that adjustments path step-by-step with out a great deal effort. However, if a fresh, impressive variable comes up, just like the worldwide COVID-19 pandemic, the economic system can change on the dime. COVID would be a veritable iceberg for the ocean liner economic system, nevertheless the ship didn’t drop! Even inside the excessive circumstances of COVID-19, my common premise on housing economics predicted that the 2 variables with one of the most affect – demographics and mortgage charges – would maintain in the housing industry. With one of these two elements nonetheless very a great deal in play, right here is my 2022 forecast.

The ten-year yield and mortgage charges

The forecast

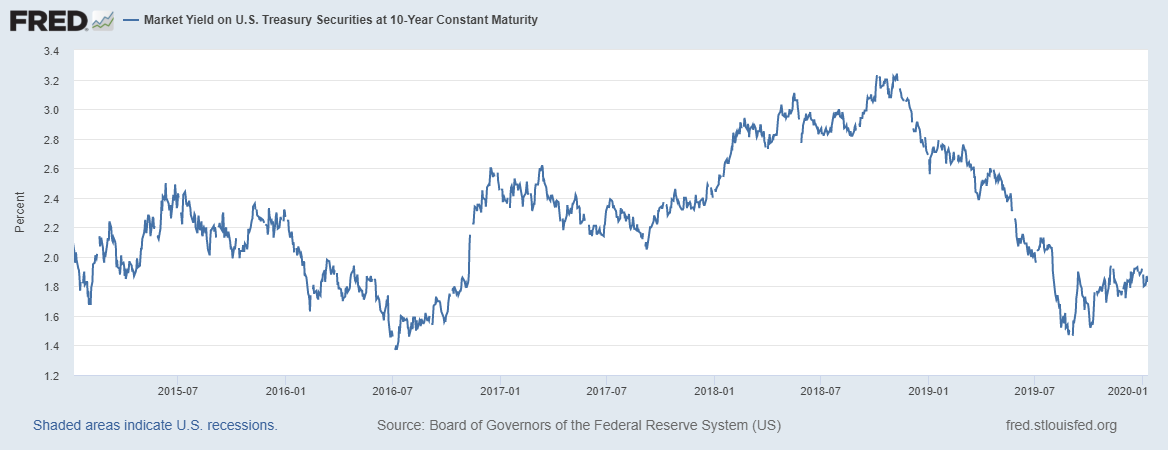

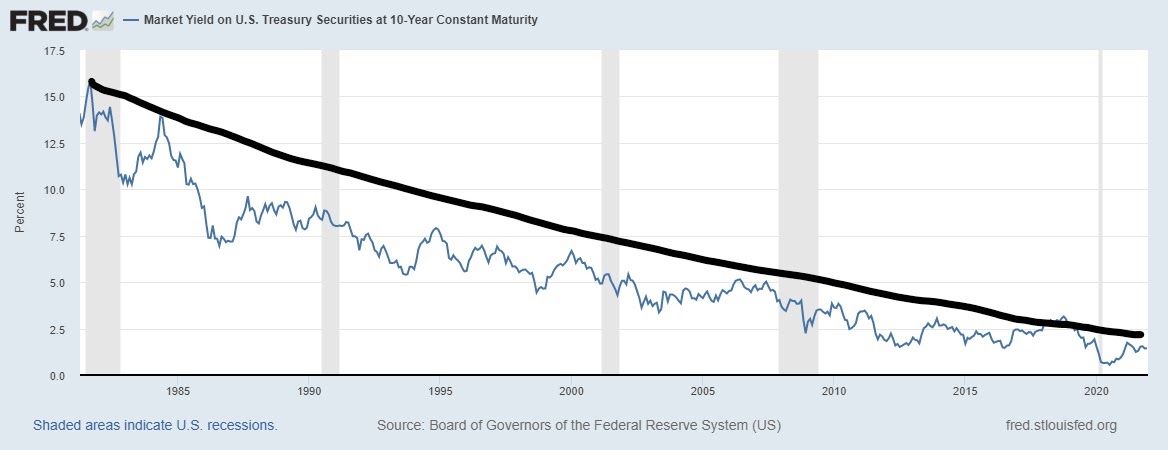

For 2022, my vary for the 10-year yield is 0.62%-1.94%, similar to 2022. Accordingly, my higher finish vary in mortgage charges is 3.375%-3.625% and the decrease finish vary is 2.375%-2.50%. That resembles what I’ve completed previously, paying my respects towards the downtrend in bond yields since 1981.

We had just a few instances inside the earlier cycle the place the 10-year yield was under 1.60% and above 3%. Associated with 4% plus mortgage charges, I could make a case for greater yields, however this might require the planet economies functioning all collectively inside a world without any pandemic. With this situation, Japan and Germany yields need to rise, that might push our 10-year yield towards 2.42% and get mortgage charges over 4%. Present circumstances don't assist this.

The backstory

The lifeblood of my financial work depends on drastically on the ebbs and flows of the 10-year yield, a lot more than mortgage price focusing on, that is uncommon for a housing analyst.

After I first dipped into 10-year yield and mortgage price forecasting in 2022, in the course of the sooner enlargement, I mentioned the 10-year yield will stay in a channel between 1.60%-3%. I've caught to that particular channel forecast yearly since – and for probably the most half that 10-year yield channel caught. That vary dictated that mortgage charges would roughly keep between 3.5%-4.75%.

When COVID-19 was about hitting our economic climate, I forecasted that the 10-year yield recessionary yields must be in a spread between -0.21%-0.62%. We obtained to as little as 0.32% with that Monday morning in March once the disaster was hitting the markets the toughest. A few month later, I revealed my AB (America is Again) restoration mannequin, which mentioned that the 10-year yield must get again towards 1%. We obtained there in December of 2022 so I was once capable of retire my America is Again restoration mannequin.

I mentioned that when the economical system was starting the brand new enlargement, the 10-year yield would create a spread between 1.33%-1.60%. This couldn’t occur in 2022 however must occur in 2022. Despite the new financial progress, the most popular inflation information in many years, and the Fed price hike dialogue selecting up, this vary of 1.33%-1.60% has organized properly for a lot of of 2022, which means mortgage charges have been going to be low in 2022.

My forecast for that 10-year yield vary in 2022 was 0.62%-1.94% which interprets to a bottom-end vary in mortgage charges of 2.375%-2.5%, and an upper-end of 3.375%-3.625%. Single mortgage price goal forecasts haven’t fared effectively within the many years as a result of these forecasters didn’t respect the downtrend in bond yields since 1981.

The X issue

Can there be a bond market promote out quick time period, sending yields above 1.94%, like what we noticed early inside the COVID-19 disaster? Sure, but when the markets do overreact for just about any motive, sometimes bond yields would fall again. Why do I not consider bond yields will push greater aggressively? The financial cost of progress peaked in 2022. The economic system was on fireplace this Twelve months, and inflation information was super-hot. Even so, the very best the 10-year yield obtained was 1.75%. The financial catastrophe aid that boosted the restoration in 2022 and 2022 continues to be drawn down.

Authorities spending plans have additionally been watered down and new laws won’t even go in any respect. Financial progress peaked in 2022 using one of the hotter inflation information has the potential to fall subsequent Twelve months. The Federal Reserve must hike charges to relax the economical system. Usually what occurs sooner than the primary Fed price hike is that the U.S. greenback has its greatest % transfer greater ,which has a tendency to harm commodity costs and world progress. That is one thing to observe for subsequent 12 months since it may decelerate world progress.

The economic climate gained't be as scorching in 2022 since it was in 2022, however it can remain in expansionary mode. Such backdrop will make it hard for charges to rise in an enormous means and keep greater. The main thing with all my 10-year yield channel work is how lengthy the 10-year stays in that channel throughout the calendar 12 months. I’ve all the time believed this sort of forecast is extra helpful than concentrating on a mortgage price.

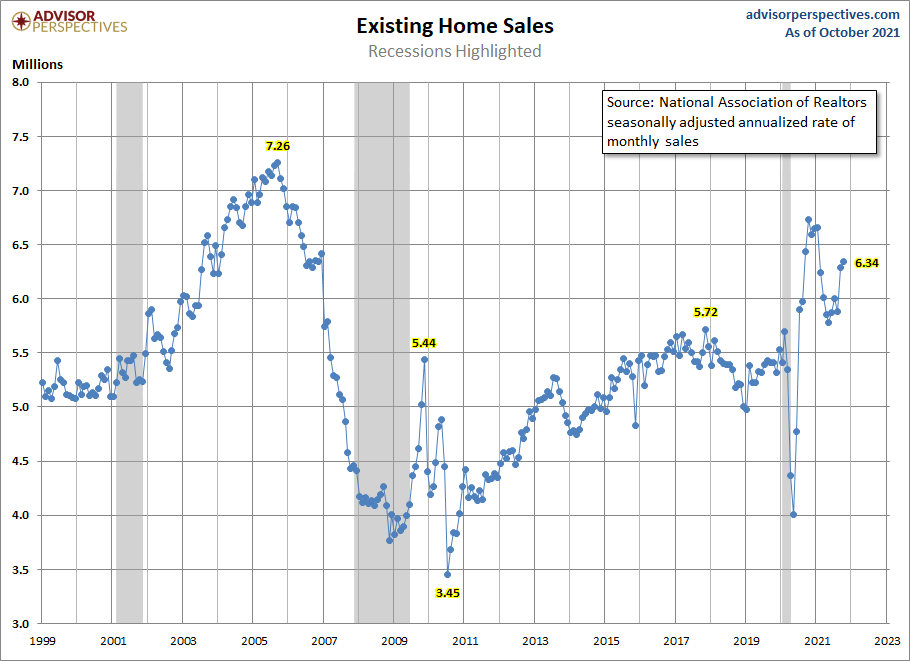

Current-home gross sales

The forecast

For 2022, I’m forecasting the identical gross sales pattern vary as 2022 of about 5.74 million to six.16 million. If month-to-month gross sales prints are above 6.16 million for present houses, then I’d contemplate the market extra strong than anticipated. If gross sales pattern towards 5.3 million then we are able to be again to 2022 ranges. This may nonetheless be wholesome product sales contemplating the post-1996 pattern, however it can imply housing demand has gotten softer.

This has occurred sooner than when greater charges have impacted demand. Due to this for the reason that summer season of 2022 I’ve discussed how if the 10-year yield can get above 1.94%, then issues must quiet down. Nonetheless, as you can see it's been exhausting to bond yields over that stage and thus mortgage charges above 3.75%.

The backstory

If the ultimate two reviews from the Twelve months on present house gross sales are above 6.Two million, I’ll admit that gross sales have barely outperformed things i predicted for 2022. At the start of 2022, I wrote that house gross sales would reasonable after the peaks attributable to the COVID-19 shutdown make-up demand and that readers mustn’t overreact for this slowing. I wrote that product sales would vary between 5.84 million and 6.Two million, and that people may anticipate just a couple prints beneath 5.84 million – however product sales would persistently be over the closing stage of 2022 of 5.64 million. We obtained one print under 5.84 million and some latest prints over 6.Two million, with two extra reviews. Mortgage demand was stable all 12 months lengthy and it has picked up inside the final 15 weeks.

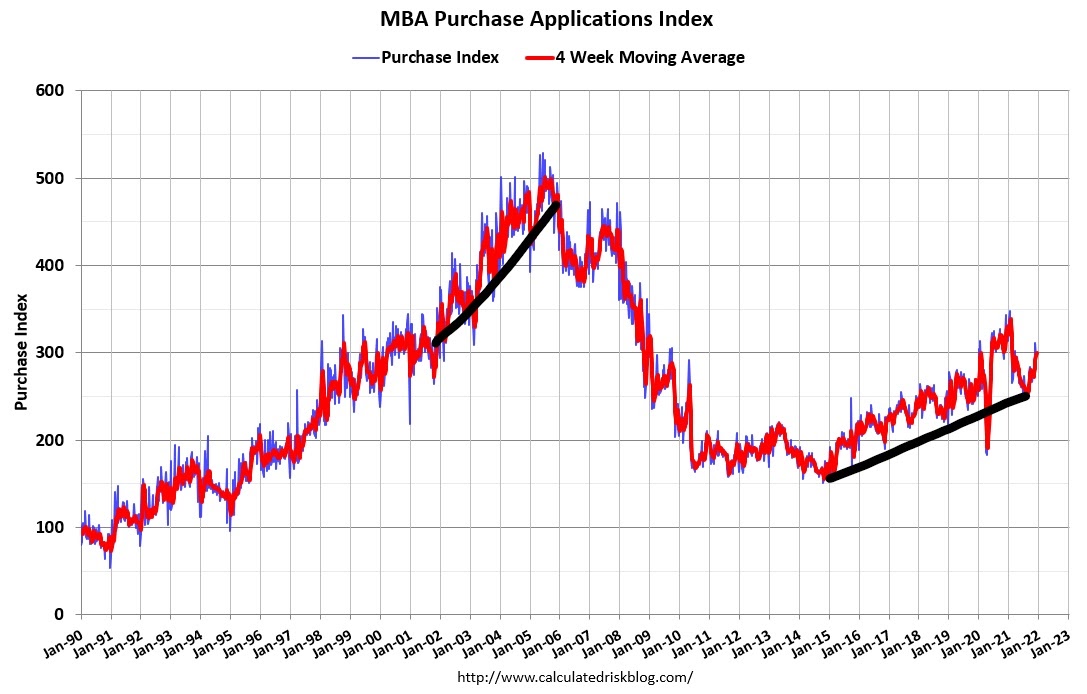

Considered one of my longer-term forecasts within the earlier enlargement was that the MBA Index wouldn’t attain 300 till 2022-2024. We obtained there inside the early a part of 2022, then the Index obtained hit by the COVID-19 delays internally looking for to solely have a V-shaped restoration that resulted in the make-up demand surge, moderation down and again to 300.

As it is possible to see, it's been like Mr. Toad's wild trip right here. We are going to nonetheless have some COVID-19 year-over-year comps to take care of up till mid February then we'll get again to regular. Nonetheless, one factor is for certain: demand has been stable and steady in 2022 and 2022. Additionally, the marketplace we now have at present doesn't seem to be the credit score growth we noticed from 2002-2005.

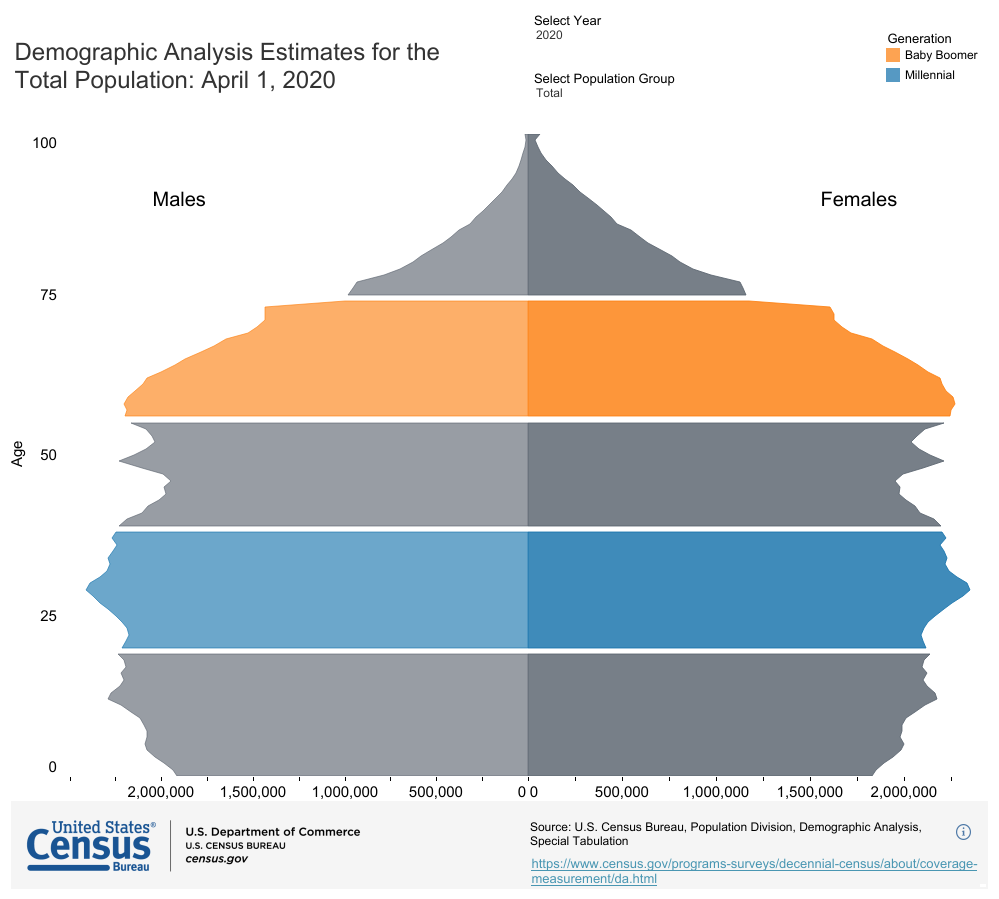

I didn’t consider whole house gross sales may get to 6.2 million inside the years 2008-2022, that is new and present house gross sales mixed. We merely didn't have the kind of demographics within the earlier enlargement. We’re in a number of instances.

New house product sales and housing begins

The forecast

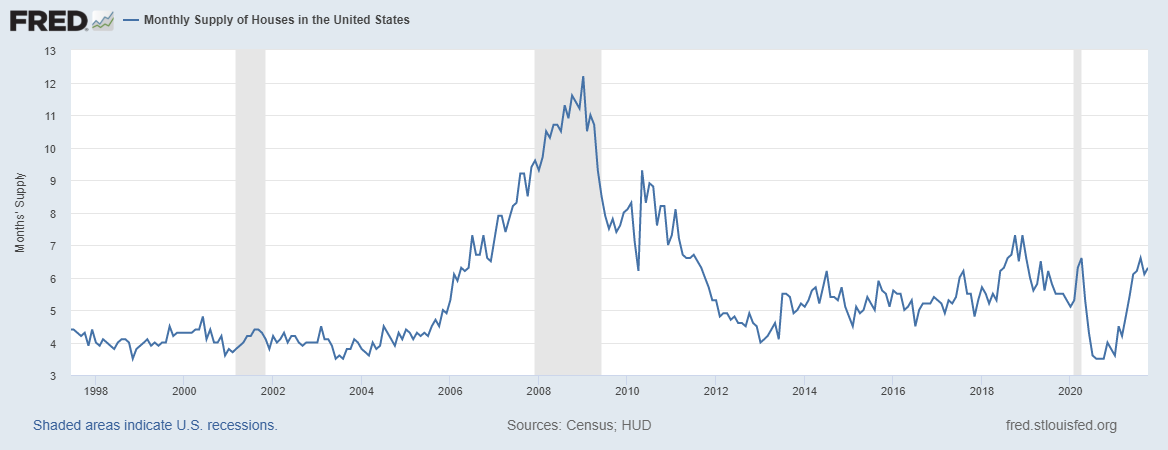

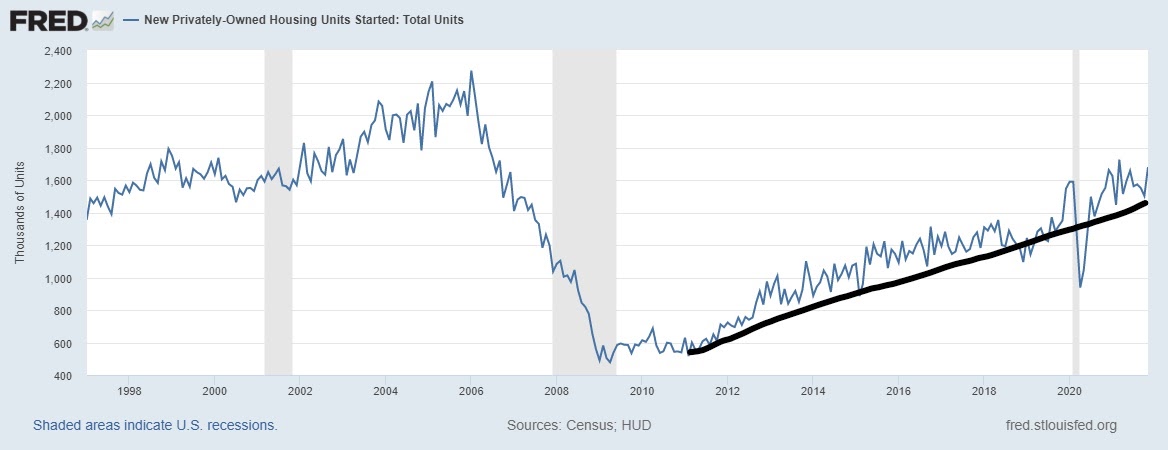

My long-term name in the earlier enlargement has been that we gained't start a 12 months at 1.5 million whole housing begins up until the years 2022-2024 so we have lastly gotten right here very like the 300 stage inside the MBA index. My guideline has at all times visited comply with the month-to-month provide information for brand new houses, and so long as month-to-month provide is under 6.5 months on a three-month common, they are going to construct.

The backstory

Housing begins, permits and builders confidence are ending the Twelve months on notice. Despite the fact that home product sales aren’t booming this 12 months, it's adequate to keep the builders constructing extra houses even with all of the drama at work shortages, materials price and delays in ending houses.

As you possibly can see under, the uptrend has been intact despite the slowdown in 2022 and the temporary pause from COVID-19.

The completely new house gross sales sector will get impacted by charges way over the present house product sales market. The ultimate time this sector noticed some stress from mortgage charges was at 2022 when charges had been at 5%. Right this moment's 3% mortgage charges are adequate to keep issues going. We must always see sluggish progress in new house gross sales and housing begins as long as the month-to-month provide of latest houses is under 6.5 months on a 3-month common. This sector has legs to walk ahead slowly. I’ve in no way believed within the housing development growth premise as mature economies do not have development booms with slowing inhabitants progress. Extra with that the following.

The X issue

The one concern I’ve with this sector in 2022 is when the builders preserve pushing the boundaries of house value progress to create their margins look higher. When charges are low, they’ve the pricing energy to do that. Due to this the sector has carried out so effectively in 2022. If I’m unsuitable about mortgage charges staying lower in 2022, and charges go above 3.75% with period, then interest in brand new houses must get hit. The longer-term concern with this sector is value progress as a result of if demand slows down, this implies a slowdown in development and the builders actually maximized their pricing energy in 2022 and 2022.

House costs

The forecast

I’m in search of whole home-price progress to be between 5.2% and 6.7% for 2022. This can be a substantial relax in value progress however would nonetheless be considered a 3rd 12 months straight of the excessive quantity of value progress for my style.

The backstory

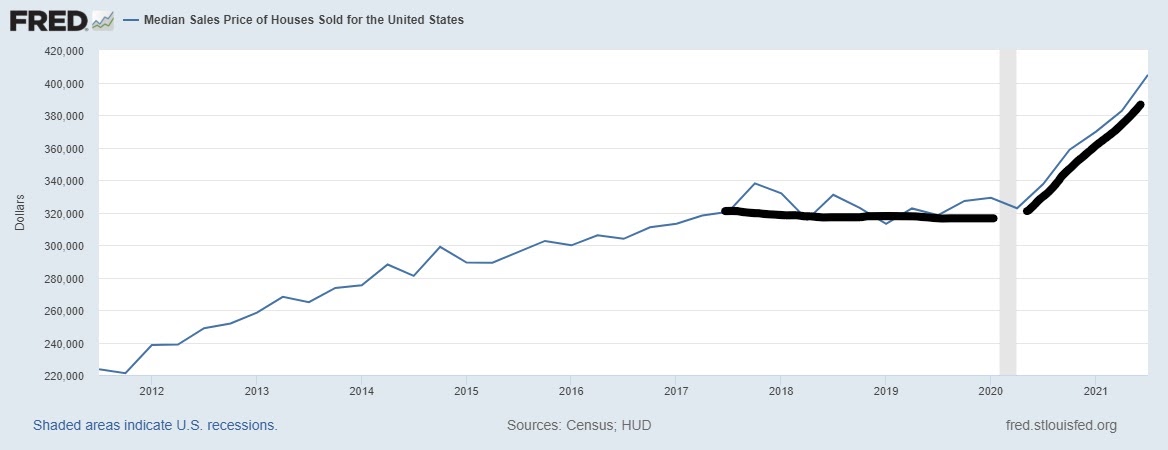

My greatest concern for that housing market throughout time 2022 to 2024 was that actual home-price progress could be unhealthy. Whenever you will have the very best housing demographic patch ever recorded in historical past occurring similtaneously the bottom mortgage charges ever, with housing tenure doubling because it has inside the final 12 years, it’s the right storm for unhealthy value progress.

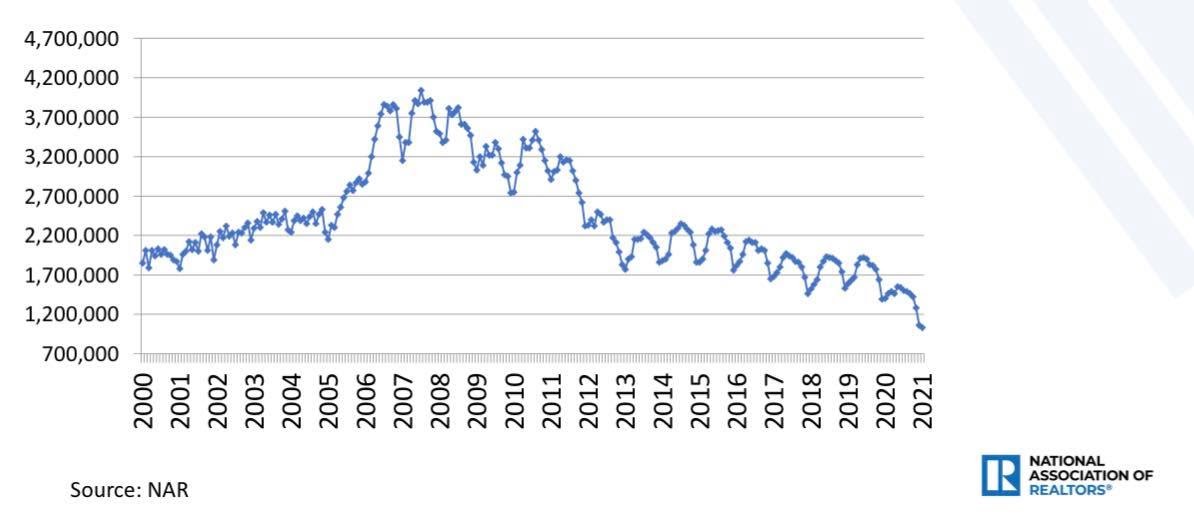

Housing stock has been falling since 2022 and mortgage buy purposes happen to be rising since that time. As you can see under, 2022 wasn't trying great for me relating to my concern for house costs rising a lot of.

The X issue

After I speak about actual home-price progress being too scorching, I imply nominal house value progress is above 4.6% annually throughout the five-year interval of 2022 to 2024, for a cumulative 23% progress. This might not be a optimistic for the housing market. When we finish 2022 with 13% house value progress, (and it seems like we’ll do this or greater), then now we have already achieved 23% of the worth progress that I’m comfy within simply two years.

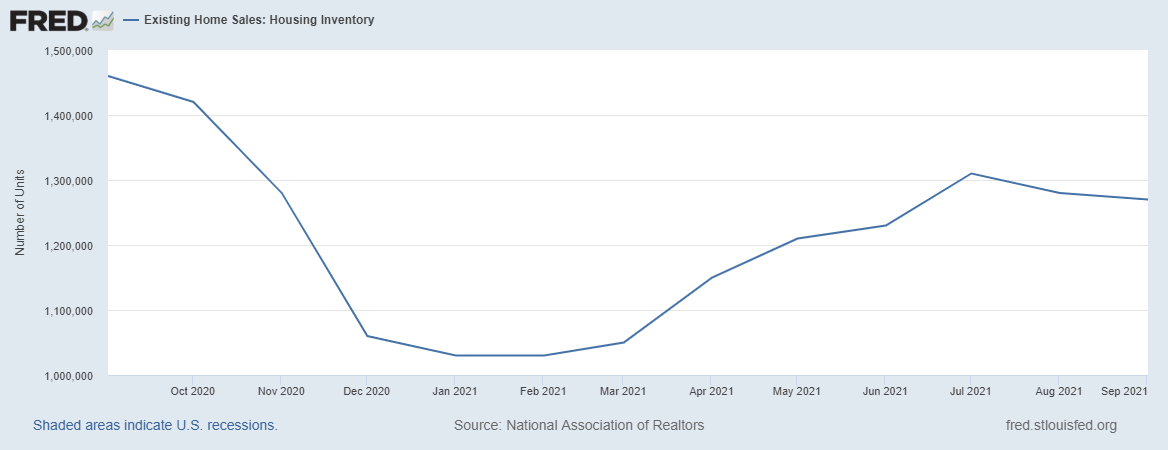

Whereas I do consider home-price progress is cooling from the acute excessive price of progress we'd earlier within the Twelve months, I’d super like to see costs get again according to my mannequin for any wholesome market. To make sure that this to occur, we'd desire to don’t have enhance internally costs for an additional three years. Because of stock ranges are falling once again, and we’re prone to beginning the 2022 spring season at contemporary new all-time lows, this final result may be very unlikely.

Early in 2022, I had raised problems that costs overheating should be the primary concern, not forbearance crashing the market. When demand is steady, it's extraordinarily uncommon for stock to skyrocket and American owners have in no way appeared higher in writing. Actually, just a few months in the past I discussed stock falling once more should be the priority heading out.

Housing demand

The forecast

Everyone seems to be talking about charges going greater and nobody, it seems, is speaking regarding the risk that mortgage charges might have to go beneath 3% in 2022, besides me. That is entrance and middle within my thoughts. I wish to see a B&B housing industry: boring and balanced. Inside a B&B market, patrons have decisions, gross sales transfer at an inexpensive tempo with out bidding wars, and the entire home-buying expertise is much less anxious and additional sane. I would like to see stock get towards 1.52 – 1.93 million, (which remains traditionally low). Nonetheless, this is often a extra steady housing market.

The backstory

Tens of millions of individuals purchase houses annually. The one factor that cooled interest in housing within the earlier enlargement was mortgage charges going over 4% with period. The rise in charges didn't crash the market as well as facilitated unfavourable year-over-year house value declines; however it did enhance the variety of days houses stayed in the marketplace.

At present the most crucial demographic patch ever recorded in U.S. background are ages 28-34, the first-time homebuyer median age is 33. If you add move-up, move-down, money and investor demand collectively, demand can be steady and exhausting to interrupt beneath the post-1996 pattern of 4 million plus whole product sales yearly within the years 2022-2024.

The X issue

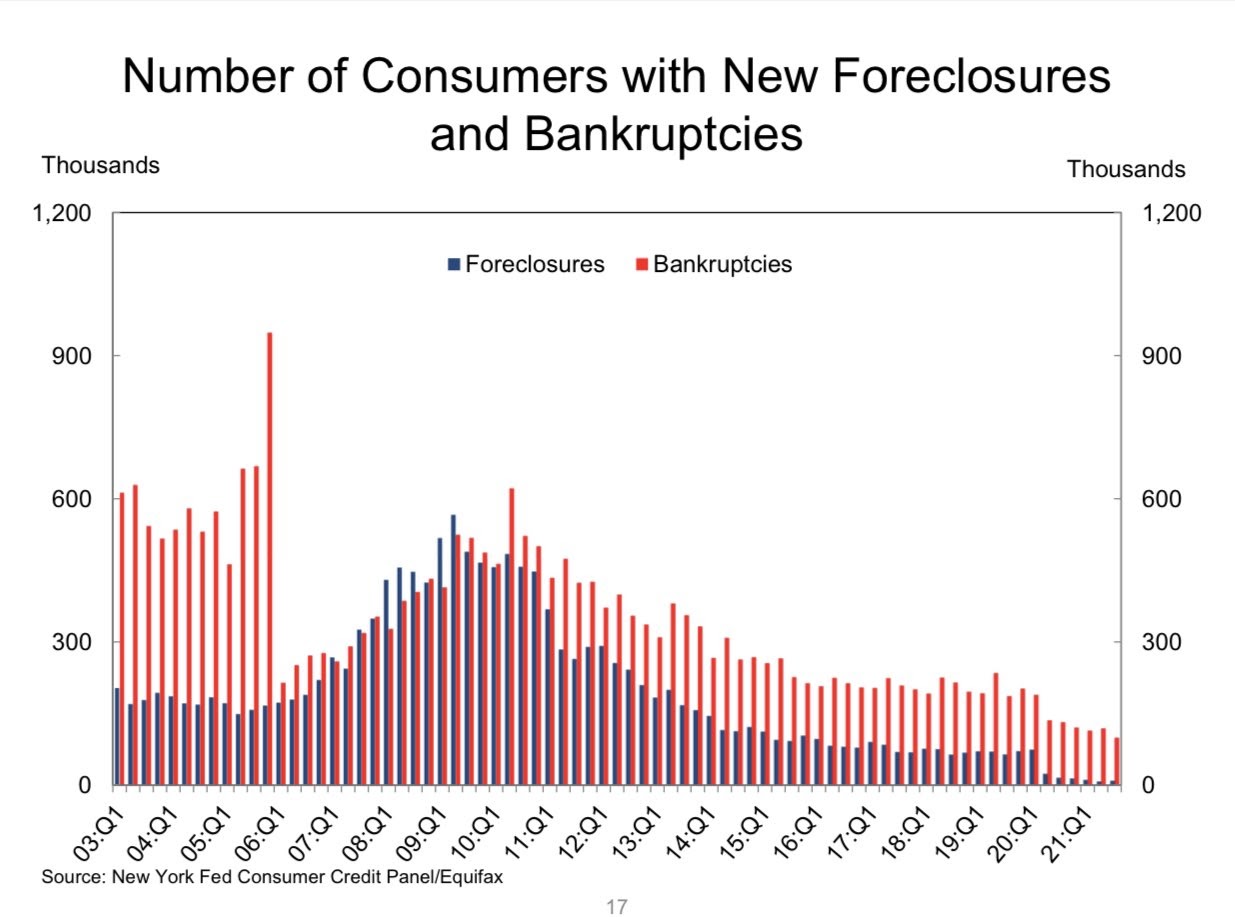

Frankly, I'm getting bored with calling the forex market the unhealthiest since 2010. This isn’t because of a massive credit rating growth or unique mortgage merchandise contaminating the marketplace with extra danger – it is the lack of alternative for patrons. If mortgage charges go beneath 3%, that we consider they will, it really retains the low stock story occurring. The Federal Reserves must chill down the economic system, the federal government has become not offering catastrophe aid anymore and also the world economies must get hit if the U.S. greenback will get too robust. So, my problem is about charges falling in 12 months three of my 2022-2024 interval. That's additionally a first-world downside of have and we aren't dealing with the housing industry of 2005-2008 when gross sales have been declining and the U.S. shopper had been submitting for chapter and having foreclosures sooner than the good recession began in 2008. That's to supply you some views right here with my pondering.

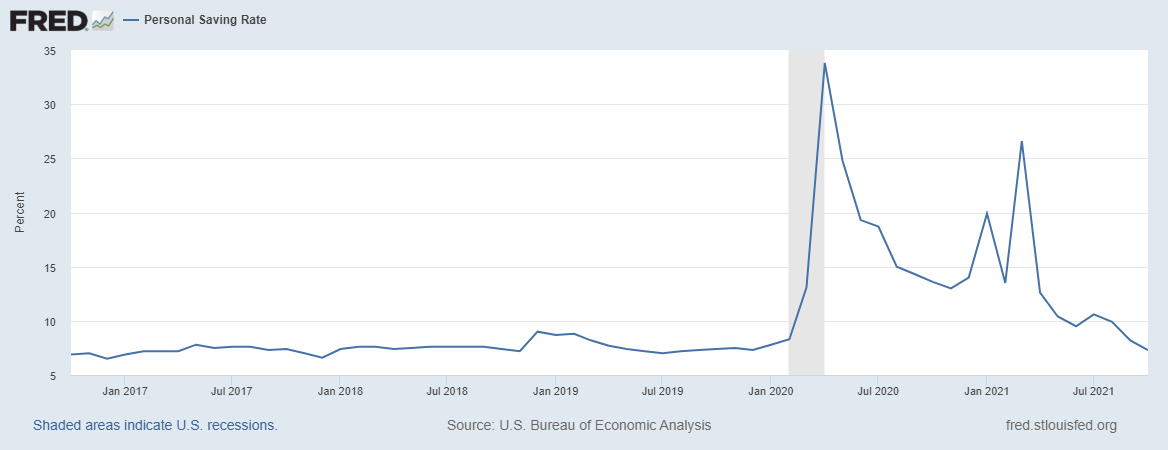

The economic system

The forecast

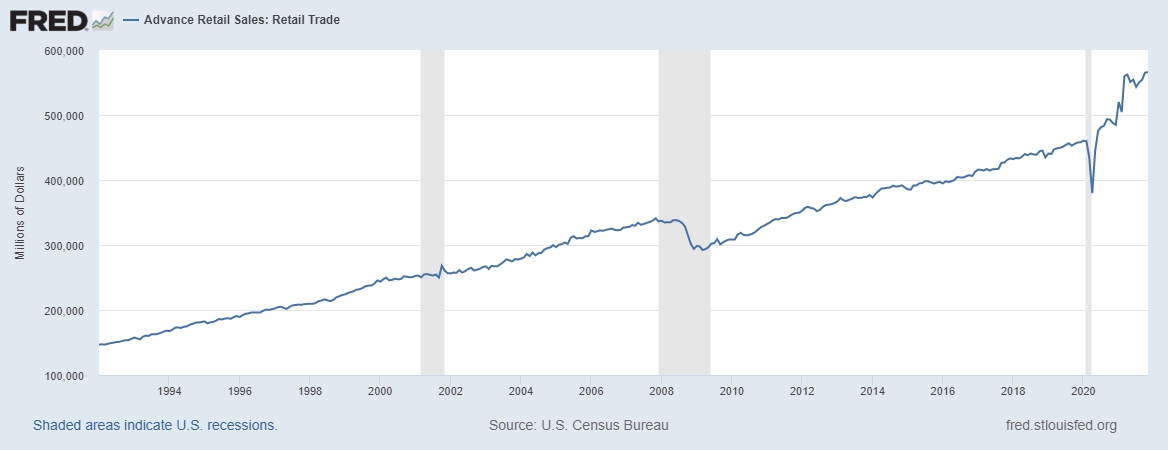

I anticipate the rate of switch to sluggish in 2022 nevertheless the economic system will nonetheless be expansionary. Retail gross sales happen to be off the charts, which information line, which I anticipated to reasonable, nonetheless hasn’t. The speed of progress will cool. Replicating the development we seen in 2022 could be practically inconceivable. Because the surplus financial savings have been drawn down and the extra checks that folks obtained are now not coming, this information line will see a extra appropriate and sustainable pattern in 2022. Nonetheless I’m shocked that moderation hasn't occurred already and I used to be the 12 months 2022-2024 family formation spending man, too.

The backstory

The U.S. economic system has been on fireplace this Twelve months. Despite the surplus cost savings, good demographics, and low charges, not even I believed we’d see financial progress like we did in 2022. Nonetheless, like all issues in life, regardless of the peaks and valleys, the general pattern will prevail.

The X issue

I not too long ago raised among my six recession purple flags after the newest jobs report since the unemployment price obtained to some key stage for myself. These purple flags are extra of the progress guidelines within the financial enlargement, and when all six of my flags are raised, I’m going into recession watch. The economical product is inside a extra mature section of enlargement for the reason that restoration was so quick. Like all spend me, it is a span of to point out you the trail of the enlargement towards the following recession.

For housing, a robust labor market means extra folks are getting off forbearance, that is already beneath A million, a lot small compared to the practically 5 million we had early inside the disaster. I would like to want a Merry Christmas to all my forbearance crash bros who promised a housing crash in 2022 and 2022. Everyone would be the best trolling grifters ever!

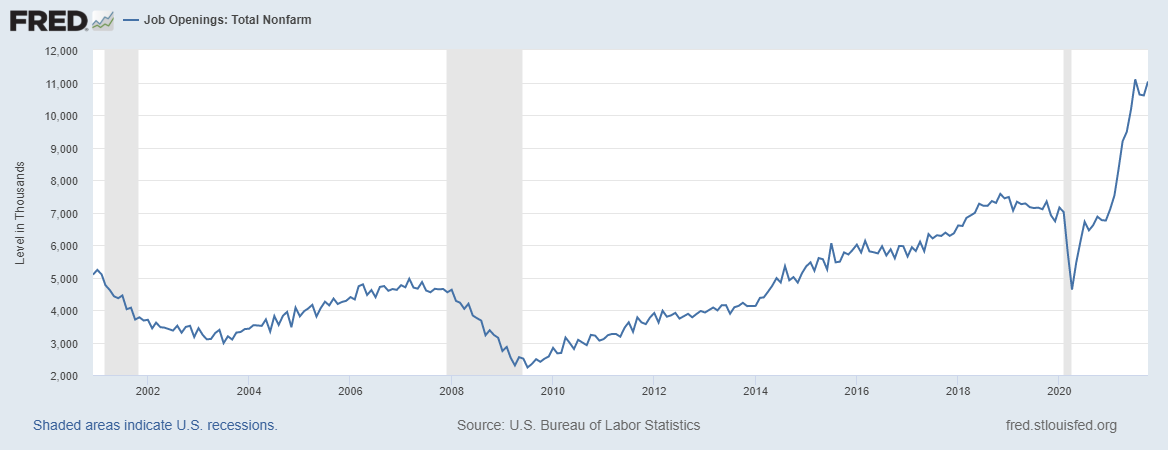

Extra jobs and extra strong wage progress imply the requirement of shelter will build up. The housing industry has already been dealing with a lot of hire inflation, however as wage progress senses the decrease finish, what this means is landlords will cost extra hire. Once again, this the issue you wish to have, tighter labor market means wage progress will choose up and now we have 11 million job openings presently.

So, search for the hire inflation story to become a area of the 2022 storyline, as well as the speed of progress of house costs trying to cool off.

There’s nothing like a fifth wave of COVID-19 and a completely new extremely transmissible variant to fire up the non-public stress meter. Whereas the persevering with COVID disaster could cause havoc on some short-term information strains for that economic system, we’ll, as we now have completed, manage means of this and transfer ahead. Our actuality is that, as a nation, now we have realized to devour items and providers by having an energetic virus infecting and killing us day-after-day.

The St. Louis Monetary Stress Index, which was a vital information line to trace for the America Is Again restoration mannequin, has nonetheless experienced a peaceful zone for your complete Twelve months, presently at -0.8564. Once we break over zero – that is taken into consideration regular stress – then now we have some market drama. Nonetheless, that wasn't the tale in 2022 and that we did not have just one day the area the S&P 500 was at correction mode. It isn't regular to not possess a inventory correction, so a inventory market correction in 2022 is inside the works and will also lead more cash into bonds and drive charges decrease.

For extra dialogue on this index and the America is Again restoration mannequin, this podcast goes over every aspect that has took place 2022-2022.

Conclusion

What a trip it has been for all of us since April 7, 2022 once I wrote the America Is Again financial restoration mannequin for HousingWire. We finish 2022 with one of many biggest financial restoration tales ever inside the historical past of america of the usa, along with a horrible, darkish, two-year interval of failure for that acute housing bears. Now we’re effectively right into a restoration and looking out ahead to some brand new 12 months using its new challenges.

The job of the analyst would be to forecast the optimistic or unfavourable impacts that a complete slew of variables dress in the economical system based mostly on rigorously formulated financial fashions. The variables, similar to demographics, the unemployment price, what the Federal Reserve does, commodity costs and so many more, will always be in flux and feed off of and affect each other. Moreover, new financial variables pop up regularly. My job, with every podcast and article, would be to point out you the way the adjustments in these variables mild the trail towards the place the economic climate and the housing market is heading.

Take an in-depth breath – in by way of the nostril and out by way of the mouth. The final two years happen to be loopy, however I’m glad you’re the following to understand this. That is our nation, the world and our universe, and everybody appears to be part of group Life on Earth. Merry Christmas, Joyful Holidays and also have a beautiful Joyful New Yr. We will get by means of 2022 one information line at a time.

“We now have at all times held to the hope, the concept, the conviction that there’s a higher life, a greater world, past the horizon.” Franklin D. Roosevelt

The publish Logan Mohtashami: The 2022 housing forecast appeared first on HousingWire.