With the discharge to Congress of the FHA Actuarial Research it’s time to get this to name: HUD Secretary Marcia Fudge and President Joe Biden must reduce the FHA Premium. Not doing so is resulting in overcharging first-time homebuyers and particularly African American and Hispanic debtors, the segments of our housing inhabitants needing the very best help.

I say this like a former FHA Commissioner so that as someone who, again when the fund was actually confused, visited Congress requesting added authority to boost premiums. And as soon as that was legislated, I raised them. This time around it's completely different. This time around we’d just like a common name to this administration, which is composed of Democrats who communicate typically of wanting to assist minority and first-time homebuyers.

The decision is that this: Decrease the FHA MIP now.

Listed listed here are the reason why:

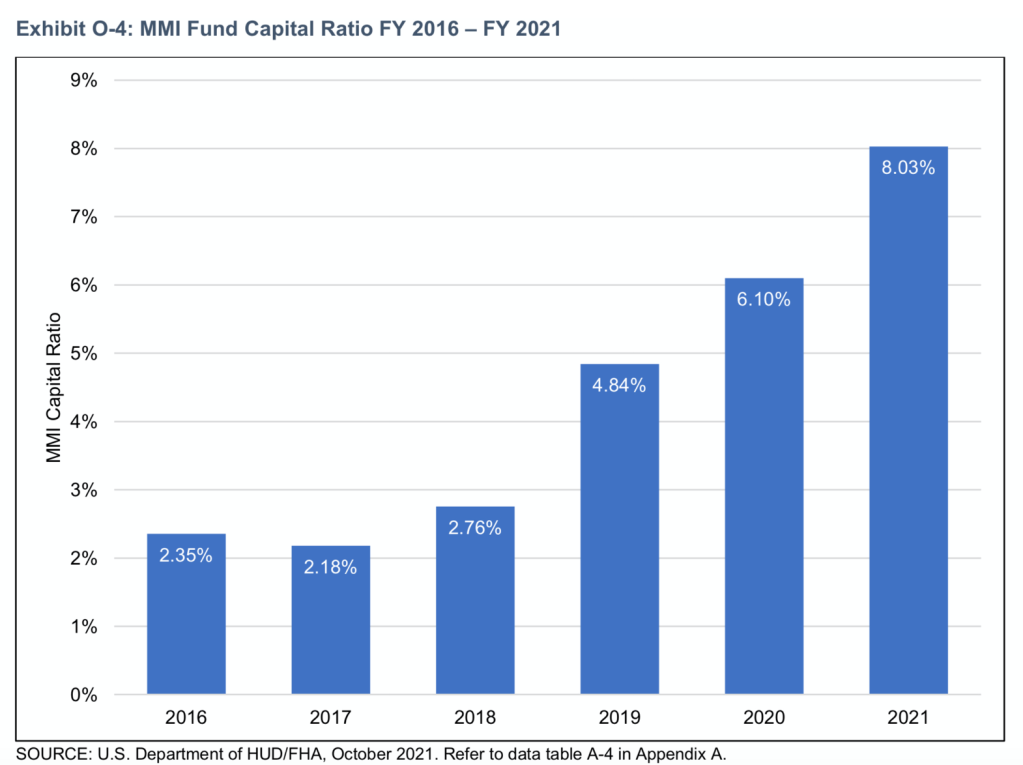

What’s the actuarial report, why it issues, and just what made it happen say? The actuarial examine is accomplished as an obligation to Congress and submitted every November. Compiled by a neutral third-party auditing agency, the examine produces a web current price of the general FHA ahead and reverse mortgage portfolios. Merely put, it looks as with any respect the insured loans within the single-family enterprise and elements in anticipated rates of interest, dwelling worth forecast, default charges and severity charges over your entire period of those loans, a number of which may be around the books for 3 decades. In the course of the Nice Recession of 2008, the forecast really went unfavorable, leading to a mandated tap into Treasury to fulfill the minimal 2% capital reserve ratio requirement.What’s the main city reserve ratio? Congress mandated, primarily based on the earlier interval once the MMI (mutual mortgage insurance policy) fund was confused, that the FHA preserve always sufficient assets to handle all forecasted losses, along with an extra 2% buffer to deal with uncertainties forward not anticipated through the actuarial agency’s examine. In different phrases, the 8.03% capital reserve ratio is extra capital above and past the Congressional requirement of the two% minimal. This half is essential as a result of based mostly about this latest report, FHA is flush with assets (cash) to cowl all losses eventually.

This week’s launch alluded to issues over critical delinquent loans and attempting to know the result of the pandemic and its impression towards the fund earlier than contemplating adjustments to any premium ranges. However the actuarial already did this. It took under consideration all loans as of their present standing. So any delay is, essentially, second guessing the actuarial itself.

I'm not arguing that forecasts usually are not onerous, nor are actuarial stories not typically seen to be fallacious, nevertheless the measurement from the present extra is big.

In truth, it’s larger than seen for FHA like a program. In different phrases, there’s greater than sufficient “buffer” to cope with any bumps inside the street forward coming out of the pandemic and also the forbearance course of.

The actuarial is evident. FHA has over $100 billion in capital to draw in from, the most important cushion ever, producing an 8.03% capital reserve ratio. Whereas some FHA watchers evaluate this reserve to financial institution requirements and can attempt to declare that that's too low when compared, remember that this reserve depends on an evaluation fitting the complete books NPV within the duration of the mortgage. That could be a a lot more aggressive normal than most personal market capital cushions respectively.

The reserve development continues to be persistently rising for the previous decade as nicely.

Whereas the MMI fund suffered large stress through the Nice Recession, primarily pushed by approximately 20% drop in dwelling costs nationally, the fund continues to be rising, exponentially growing reserves by over $20 billion since final yr alone and nearly $58 billion over the previous 2 yrs.

However you will find dangers.

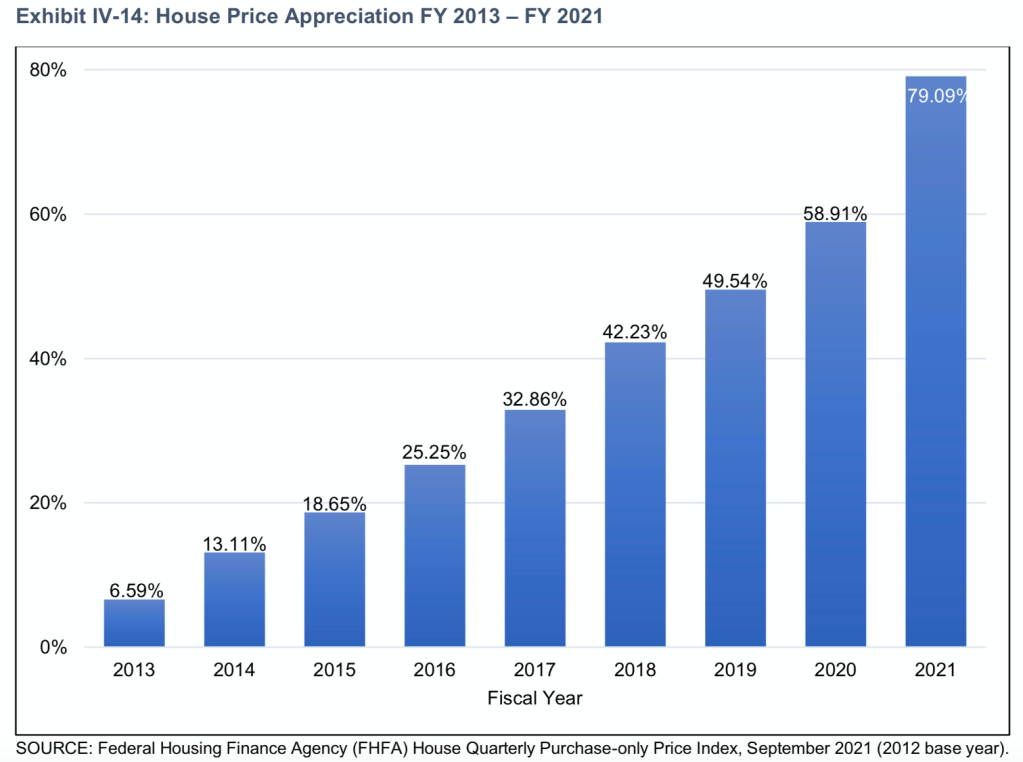

The report worries about outcomes in the pandemic and exactly how that will impression the fund. However two issues are clear. First, severity threat is completely totally different in comparison to the Nice Recession as dwelling costs have risen dramatically in comparison to the declines that occurred in the 2008 recession.

This fairness cushion is essential to producing the safety web desired to maintain the fund wholesome. In reality since 2022, as reported inside the FHA report on their behavior to Congress, the most popular dwelling in the usa has risen in worth by 79.09%. It is a large fairness cushion that will blunt the blow of virtually any financial rise in any simulation.

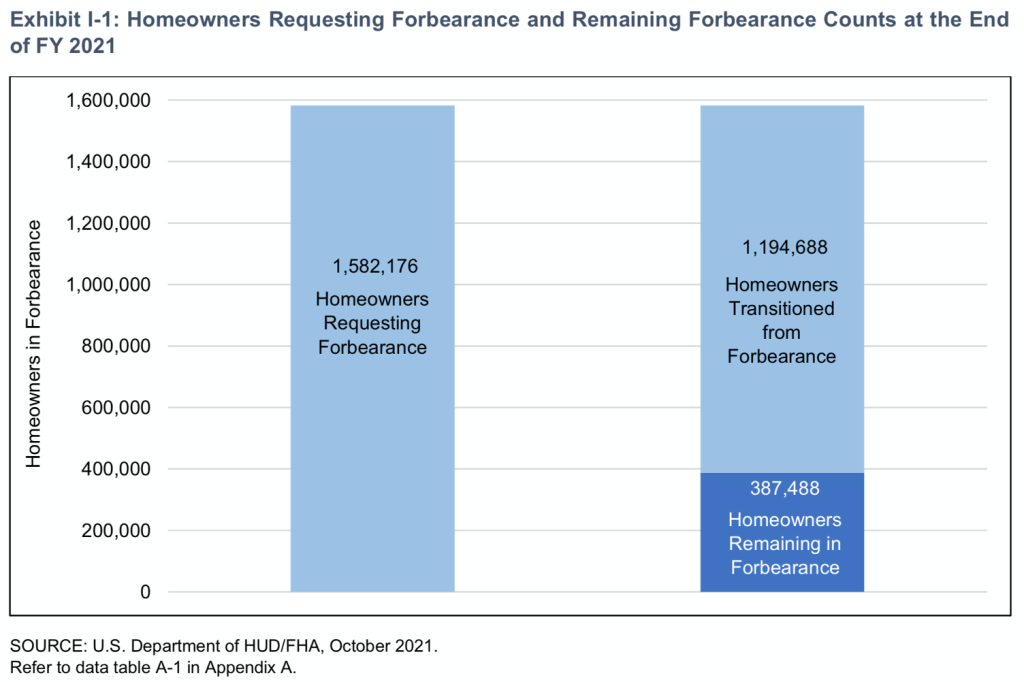

Secondly, we now have seen the sense of the brand new waterfall modification efforts applied at FHA and exactly how efficient they’re. In reality, the FHA forbearance numbers are clearly exhibiting the impact, in a great way, with nearly all of owners already transitioned from forbearance.

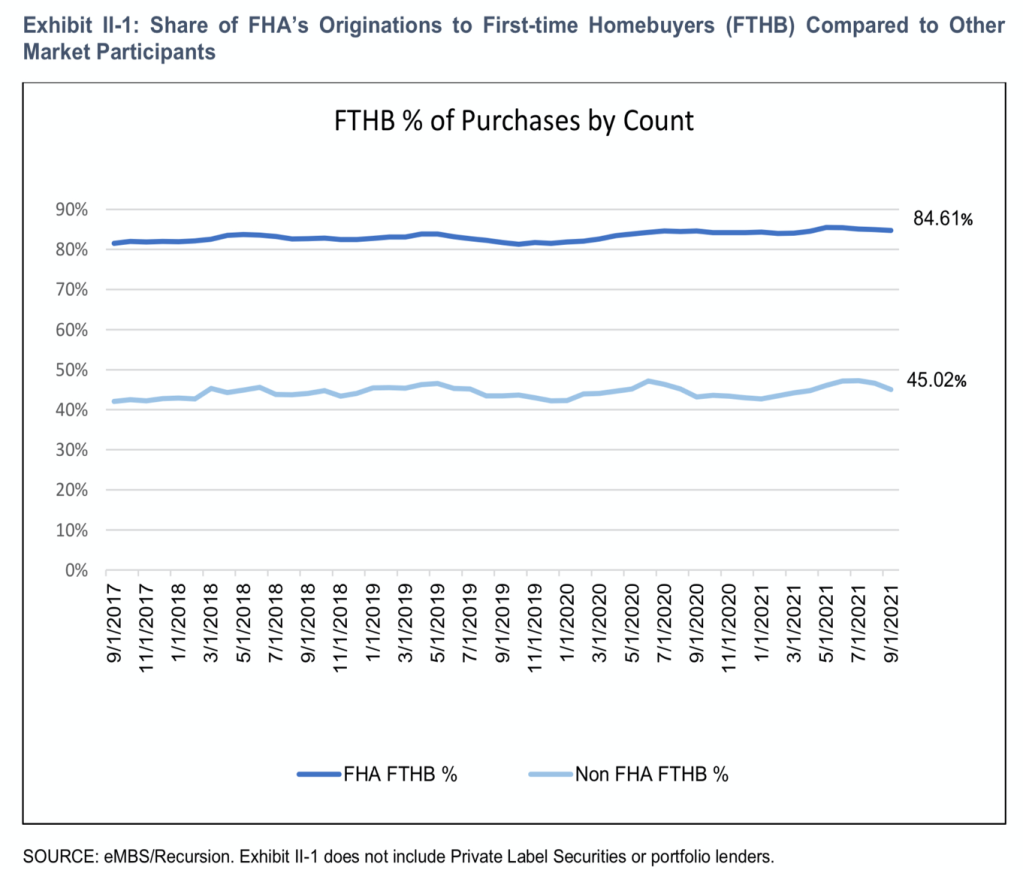

So, can you explain that this vital? As a result of failure to scale back premiums now implies that first-time homebuyers, and minority homebuyers, will face an extreme homeownership tax that’s pointless. Simply take a glance at HUD's personal information on FHA lending:

1. 84.61% of FHA loans are to first-time homebuyers. Evaluate this towards the bigger market of the GSEs who solely hit a forty five% FTHB fee and it’s clear that FHA is the first entry program to homeownership and hits youthful individuals at a time the area each penny counts – excess of these in larger earnings brackets.

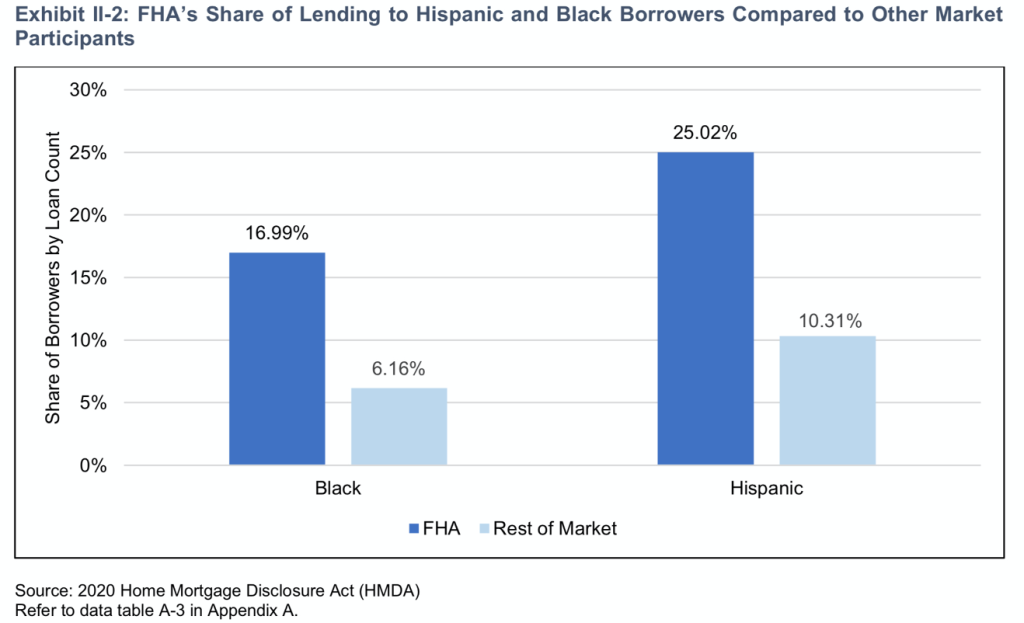

2. FHA may be the first reference for Black and Hispanic debtors. 17% of all loans produced by FHA happen to be to black debtors and 25% to Hispanic debtors. Evaluate this to the a lot bigger personal market of the GSEs, VA and additional the area their function is 6% and 10% respectively. FHA is the first way to obtain finance for youthful and extra numerous debtors who’re buying their first dwelling and proportionate to the a great deal bigger volumes from the GSEs mixed, this solely exacerbates their distinctive function on this crucial area that the President and Secretary Fudge discuss so typically. In different phrases, as John Kennedy requested, “if not us, who? if not now, when?”

There’s a lot extra the following that needs FHA to take motion and now. However let me summarize the standards the following.

FHA is having a crucial function to help minority and first-time homebuyers.Holding premiums excessive, as they’re now relative to threat, is solely a value switch on the backs of those that want this financial savings one of the most. In reality some might reason that they’re holding premiums excessive because these enormous reserves are handled like income to appropriators and can be employed to fund different authorities applications. It may be horrible to assume that policymakers would help a regressive tax on the backs of one of the most needy homebuyers to push income into different finances wants of Congress and also the administration.The impartial actuarial examine takes under consideration all forecasted losses for your entire FHA guide. Suppressing on premium reductions when FHA is printing enormous income (known as unfavorable subsidy in finances communicate). There isn’t a motive to delay a transfer the following. Each single borrower who closes on the mortgage every single day is paying an additional tax for any authorities program that’s made to carry reserves based mostly on security and soundness, however to not be a revenue middle for various federal applications.

Look, I’ve heard all the arguments towards a premium discount. They vary between GNMA investor confidence to previous background. After i was Commissioner, and in years after that, I led the struggle towards premium reductions as I held deeper issues about constructing a cushion so your FHA program would by no means be in danger on-going. However we’re nicely previous that time. Holding the premium this excessive once the fund is rising only at that fast a tempo is harming the debtors whom this administration spends a great deal time speaking about.

The time is now. Reduce the FHA MIP.

David Stevens is former FHA Commissioner and has held varied positions in actual property finance, together with serving as senior vp of single household at Freddie Mac, govt vp at Wells Fargo Residence Mortgage, assistant secretary of Housing and CEO of the Mortgage Bankers Affiliation.

This column doesn’t essentially mirror the opinion of HousingWire's editorial division and it is homeowners.

To contact the author of this story:

Dave Stevens at dave@davidhstevens.com

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com

The submit Opinion: FHA must decrease Mortgage Insurance coverage Premium appeared first on HousingWire.