In the present day, the Bureau at work Statistics reported that 199,000 jobs had been made in December – a miss from estimates. In addition they reported we'd 141,000 in optimistic revisions to the earlier jobs report. The unemployment fee is at the moment at 3.9% and we'd another large print in the family survey which confirmed 651,000 jobs gained. For women and men age 20 and also over, the unemployment fee reaches the moment at 3.6%.

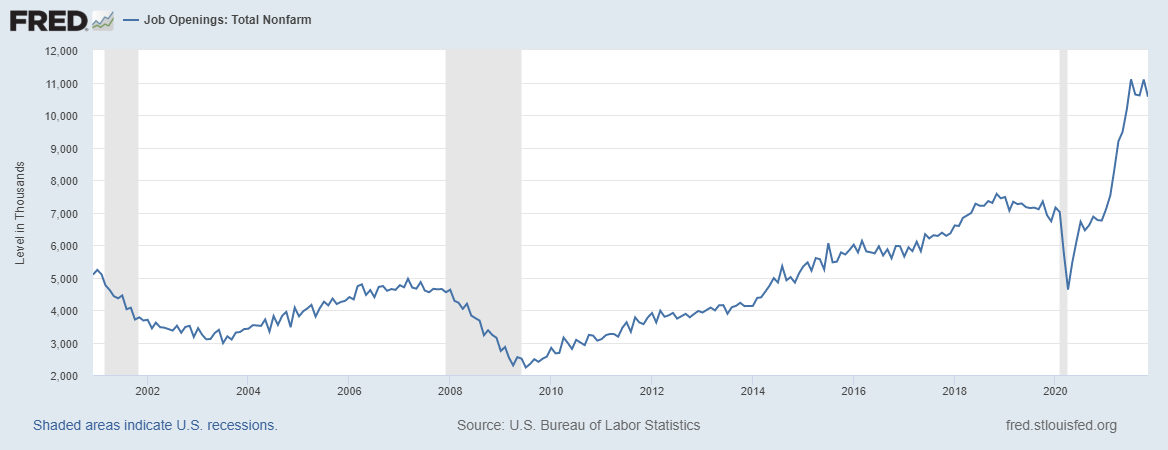

In contrast to the earlier growth, the area the roles restoration was gradual, we've a a lot completely different dynamic this time around round. Job openings are nonetheless over 10 million and I’m nonetheless smiling right here as I was once the one particular person on Twitter finance that had been tweeting out #JOLTS 10,000,000 effectively sooner than the job opening information became popular. I’ve constantly thought that no nation includes a Dorian Grey labor market. Individuals neglect that job openings had been above 7 million within the earlier growth earlier than COVID-19 hit us. Nature, getting older, and deaths are highly effective financial forces, and robots by no means took all the roles.

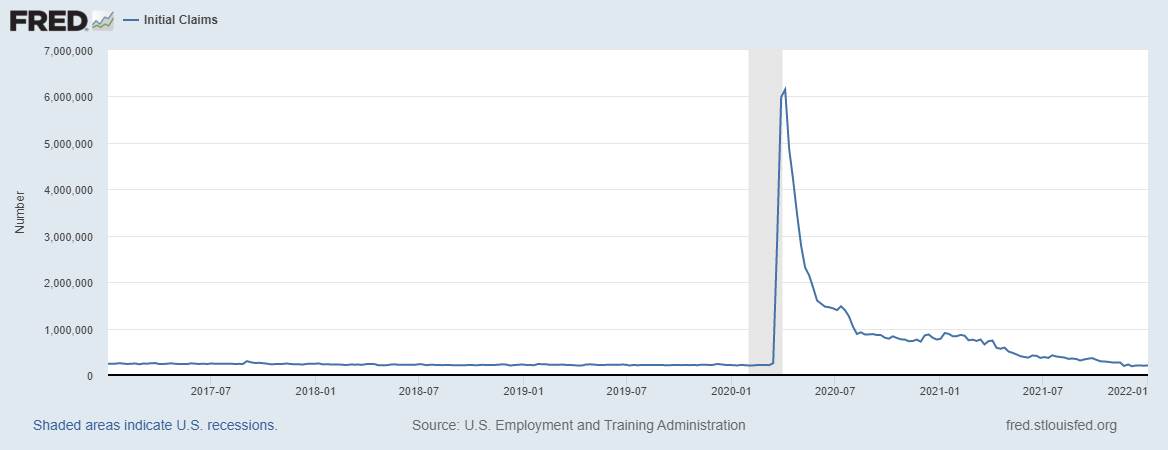

Jobless claims information not too long ago hit ranges final observed in 1969.

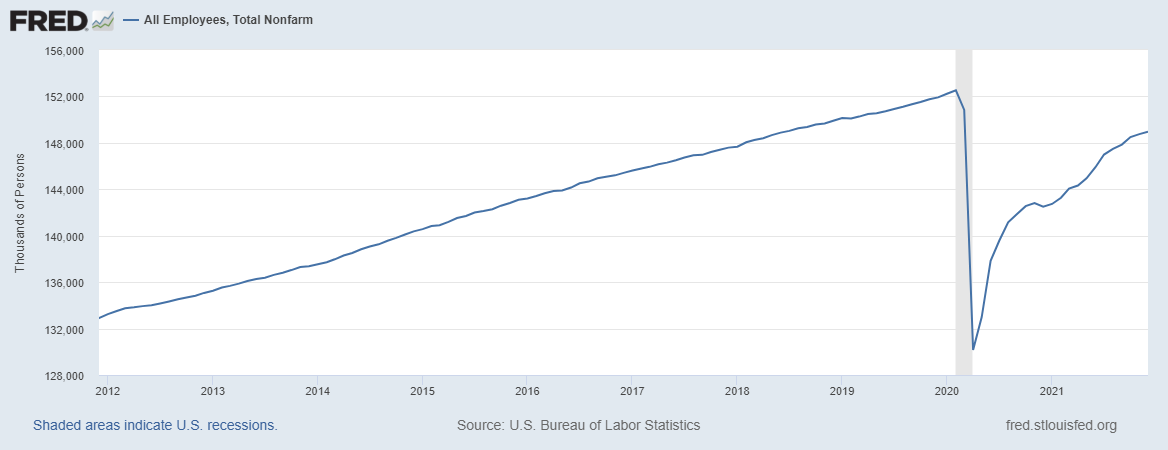

With that stated, the household survey jobs details are way stronger, exhibiting an average three-month achieve of 723,000 versus the BLS information operating at 365,000. We all do have sufficient labor to obtain again to pre-COVID-19 ranges and that i do anticipate with time to determine vital optimistic revisions to jobs information this yr. I’ve been counting the months to ascertain if my forecast might be right.

With 9 months left up until the surface of September 2022 (the milestone in my forecast), let's wait and watch the way a lot progress we want:

Feb 2022: 152,553,000 jobsToday: 148,951,000 jobsThat leaves 3,602,000 jobs left to understand inside the subsequent 9 months, which is 400,222 jobs per thirty days. With a 3.9% unemployment fee!

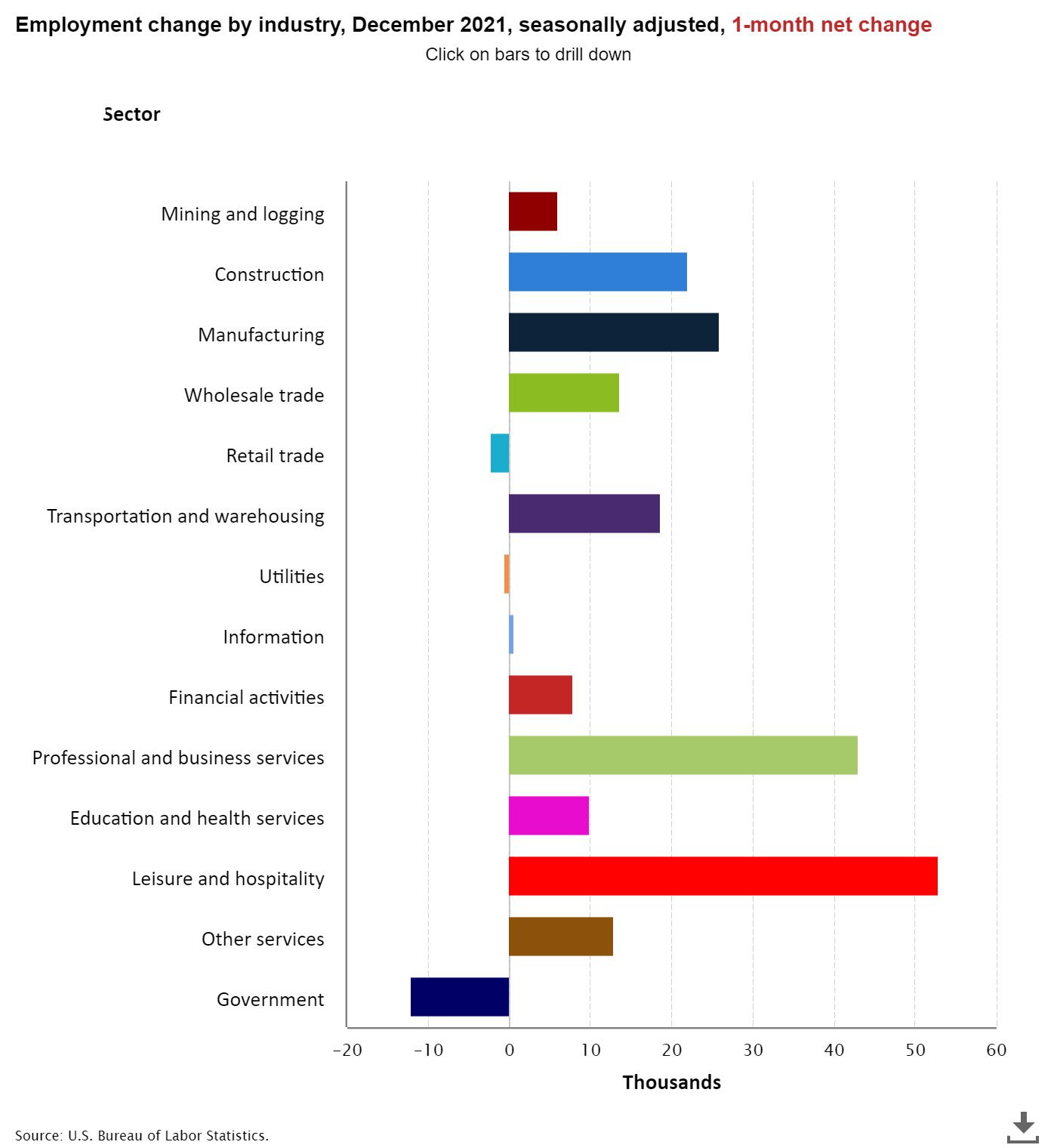

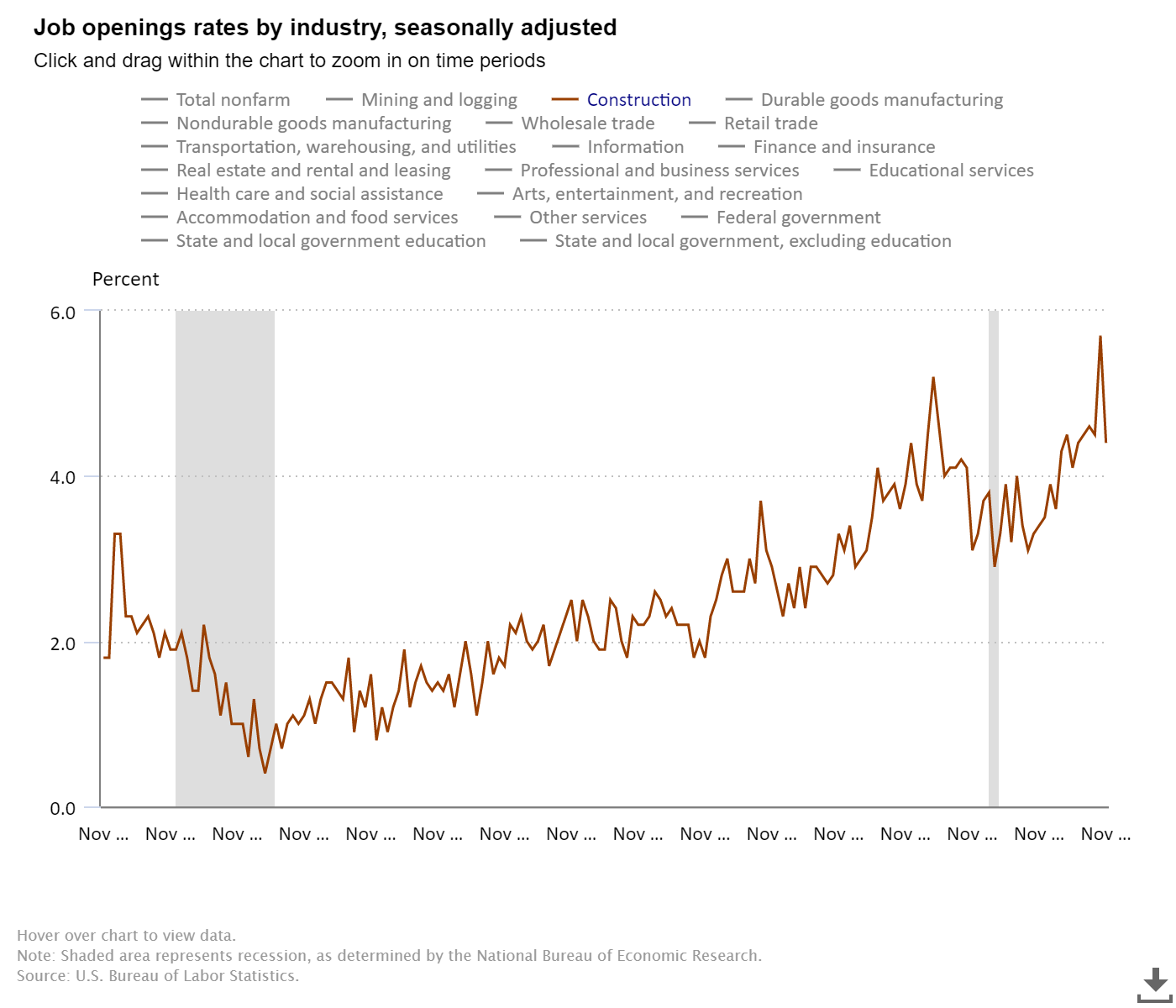

Here’s a check out the job strengths and losses reported at present. Building jobs came in optimistic however we nonetheless have a reasonably excessive stage of development job openings right now. The dearth of development productiveness within the many years continues to be one purpose why I’ve by no means believed in a housing development increase in America. The alternative purpose would be that the builders do not ever oversupply a housing market, then when demand fades, same goes with development.

The builders happen to be complaining about labor for a long time. Nonetheless, the builders confidence index has acquired as a result of they consider they’ll promote their product and become profitable since they’ve pricing energy. This additionally means housing begins are rising. Don't allow it to be extra difficult of computer should be.

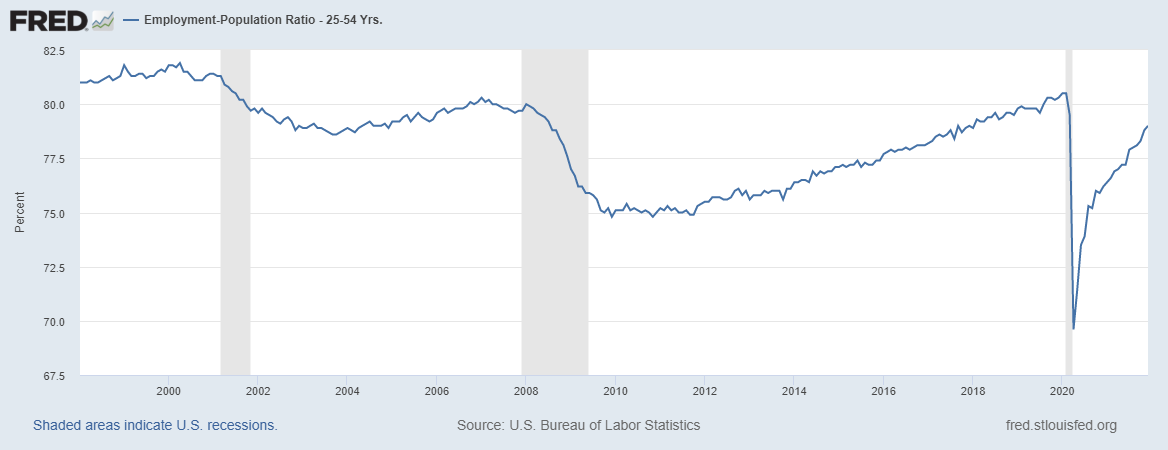

Do remember that when jobs information, it's all regulated the time about prime-age employment information for a long time 25-54. The employment-to-population share for the prime-age labor pressure is 1.5% away from being again to February 2022 ranges. The roles restoration on this new growth has been a lot much better than we noticed through the restoration part after the good monetary disaster.

Schooling and employment

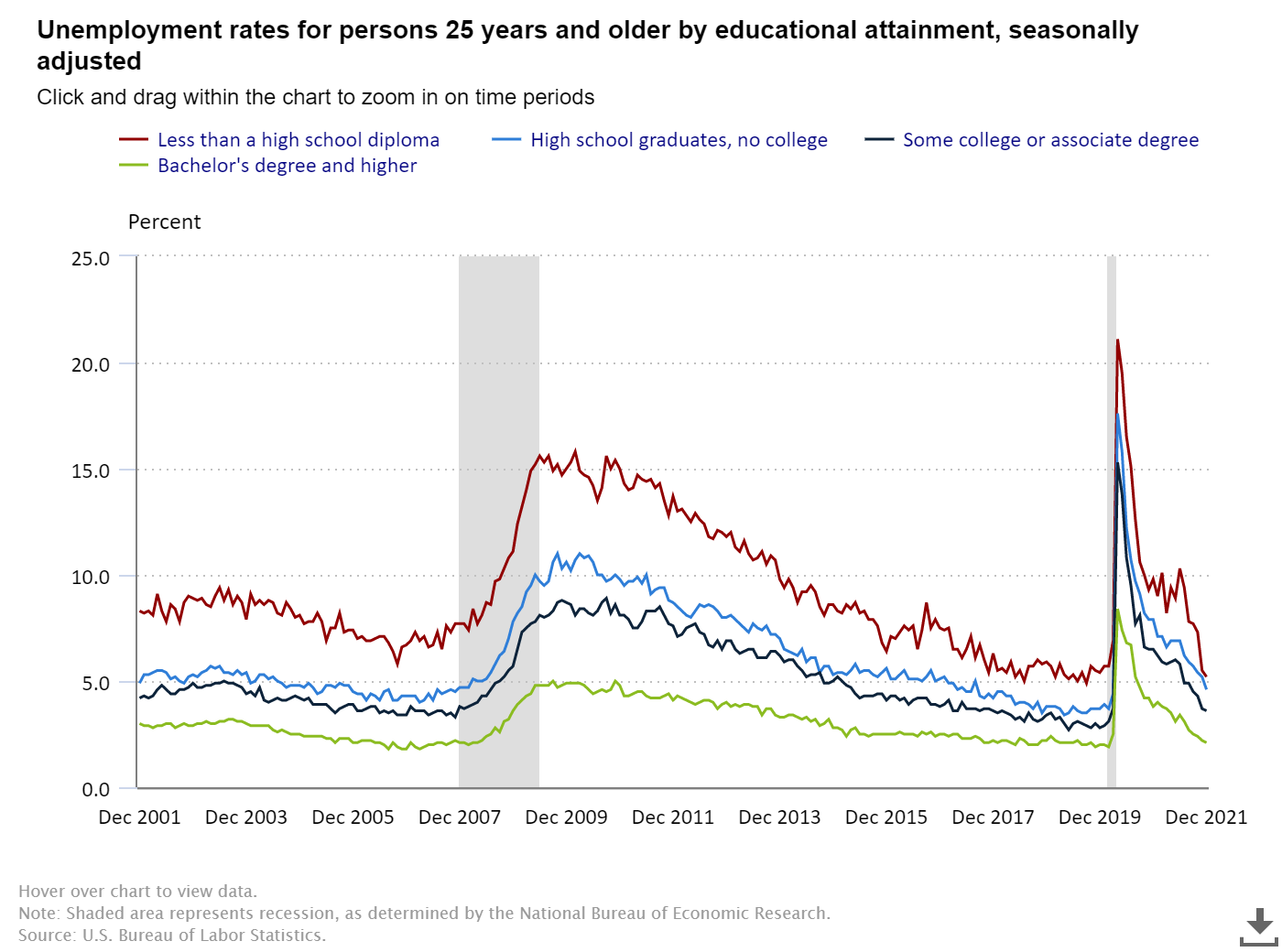

Most those who wish to work in our nation are utilized regularly. I do know that a lot of people blame COVID-19 because of not going again to operate, however context is important: almost all of the nation’s inhabitants is working at present. The an element of the labor pressure using the least instructional attainment has a tendency to possess a better unemployment fee. On Twitter, I began the hashtag A Tighter Labor Market Is A great Step to remind everybody that the economic system runs sizzling when we are in possession of tighter labor market. We want to see the type of unemployment charges that college-educated individuals have unfold to everybody, as a result of we've tons of jobs that don’t want a university schooling.

The unemployment fee for individuals who in no way completed highschool continues to be falling sharply currently, which implies the labor market is getting tighter and tighter each month. You wish to have this downside somewhat than the opposite means round.

Here’s a breakdown of the unemployment fee and academic attainment of these 25 years and older: -Lower than the usual highschool diploma: 5.2%.

-Highschool graduate with no school: 4.6%.

-Some school or affiliate diploma: 3.6.

-Bachelor's diploma and better: 2.1%.

As it is possible to see above, life is nice of these looking for employment. For businesses that want labor, it isn't the most effective information, however once more, it’s first-world American issues – the economical system is sizzling! As I’ve harassed from April 7, 2022, the U.S. restoration was going too quick, which might shock many people as a result of they’d no religion of their financial fashions.

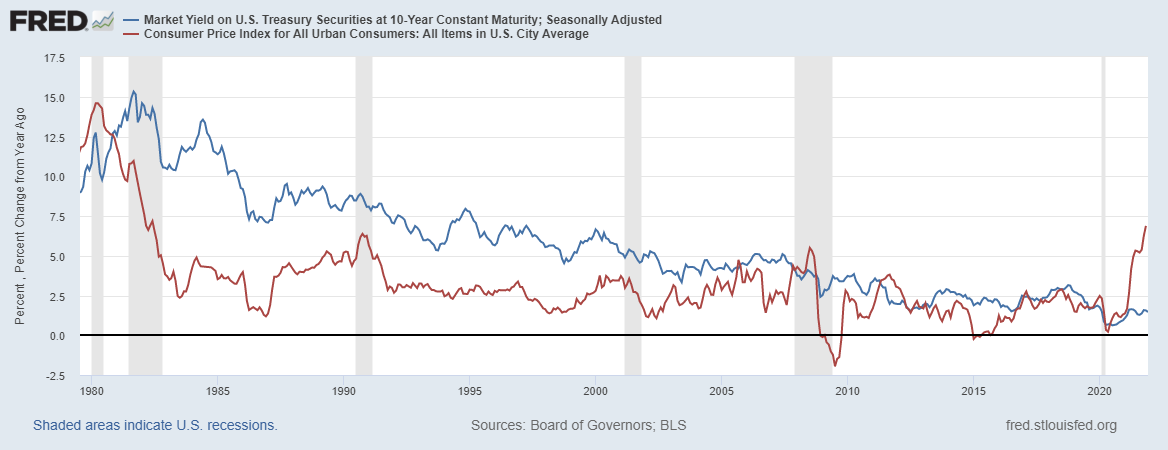

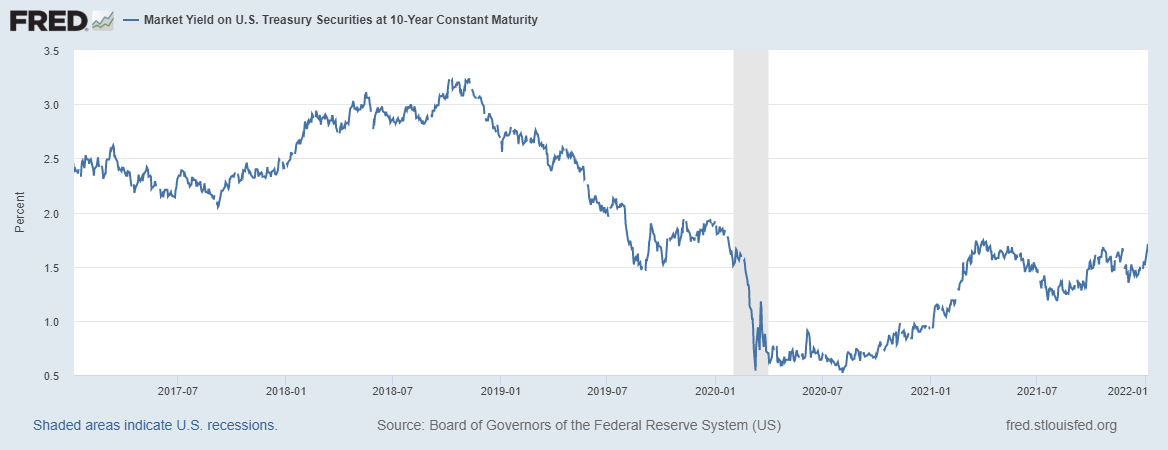

With close to record-low unemployment and enormous job openings, you’ll assume mortgage charges needs to be skyrocketing, however they’re not.

The ten-year yield and mortgage charges

My 2022 forecast stated: For 2022, my vary for the 10-year yield is 0.62%-1.94%, similar to 2022. Accordingly, my higher finish vary in mortgage charges is 3.375%-3.625% and the decrease finish vary is 2.375%-2.50%. That resembles what I’ve performed previously, paying my respects to the downtrend in bond yields since 1981.

We were built with a couple of instances inside the earlier cycle the place the 10-year yield was under 1.60% and above 3%. Relating to 4% plus mortgage charges, I could make a case for larger yields, however this is able to require world economies functioning all collectively inside a world without any pandemic. For this state of affairs, Japan and Germany yields must rise, which might push our 10-year yield towards 2.42% and get mortgage charges over 4%. Present situations don't assist this.

Sure, it does appear unusual, we now have the most popular economic system in lots of years and inflation is sizzling nevertheless the 10-year yield when i write that's at 1.75%. Don't ignore the pattern is the pal on bond yields and mortgage charges for several years. We'd a significant fall in headline inflation that did not take bond yields reduction in exactly the same means in 2009-2010 and today you're seeing the opposite having a short-term spike inside the inflation fee of development with yields not rising both.

Regardless that we haven't examined 1.94% but, we’re attending to an thrilling space the area we would be capable of begin to see the primary actual check of 1.94% since 2022. Keep keep an eye on the shut from the 10-year yield at the moment and find out if we get some bond market sell-off subsequent week. If not, the text market can rally and yields can fall quick time period as we’re oversold on the bond report.

Financial cycle replace

Now for an financial replace. To date, so good, despite the Omicron circumstances exploding larger, we merely don't see the financial and market reacting any extra as we are in possession of discovered to devour items and providers by having an energetic virus infecting and killing us every day. It has been the situation because second surge in 2022, and even though sectors of the economic system won't execute at complete capability with circumstances rising, it's not like what we noticed in March of 2022.

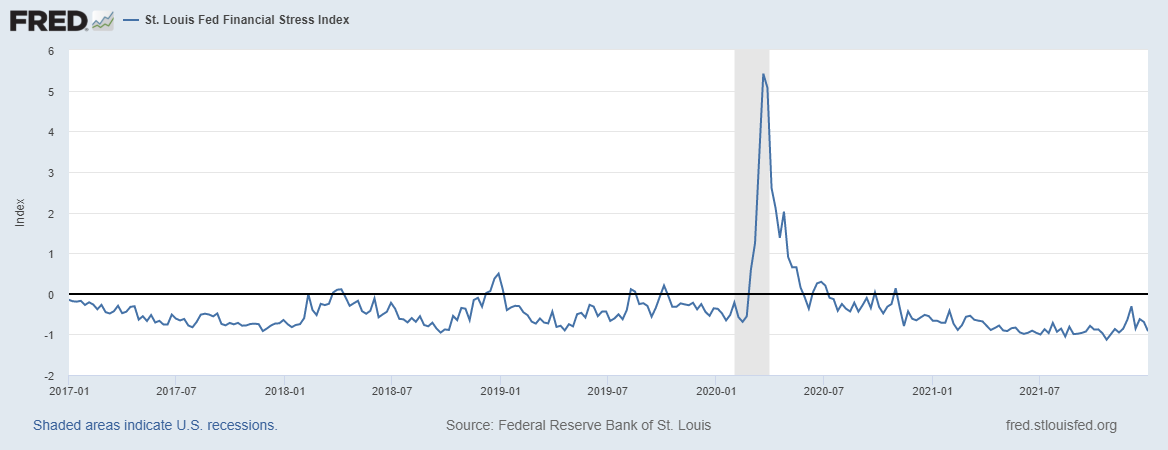

The St. Louis Monetary Stress Index, an important variable within the AB restoration mannequin, remains appearing bored out of its thoughts with a current print of -0.9201%. This could rise when the markets respond to emphasize, so don't assume we might attend these low ranges endlessly. We nonetheless haven't were built with a inventory market correction of 10% plus because March lows in 2022.

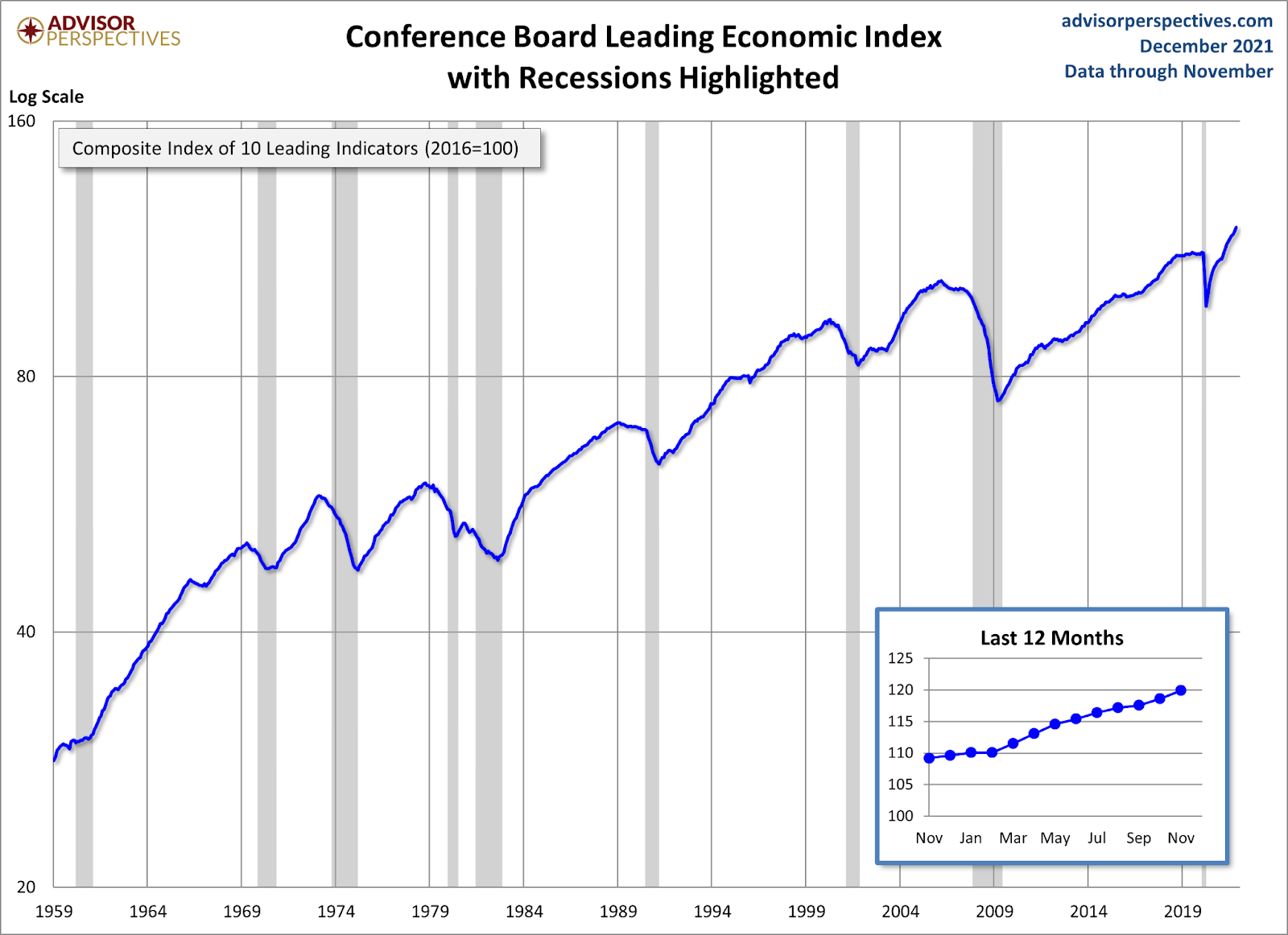

The main financial index continues to be very stable currently, when this information line falls for 4-6 months straight, then the subject gets to be completely different. Nonetheless, this was not the situation, it bottomed in April of 2022 and it has had a pointy rebound.

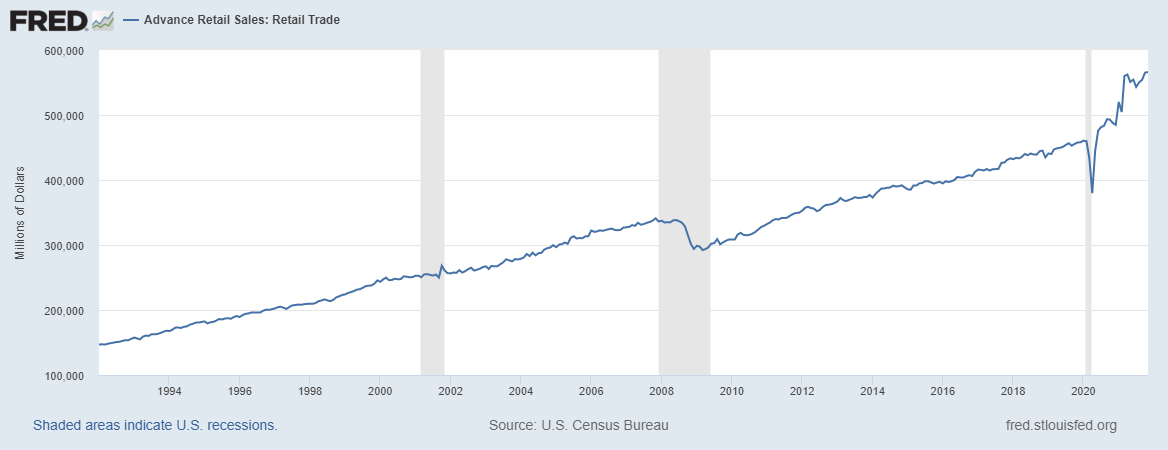

Retail gross sales are nonetheless from the charts, however I don't consider we'll possess the type of development we noticed final yr. Moderation may be the thing to retail product sales information going out, however what a loopy experience in 2022. Anticipate much less purchases on items and additional service spending going out, particularly once we are lastly performed with COVID-19.

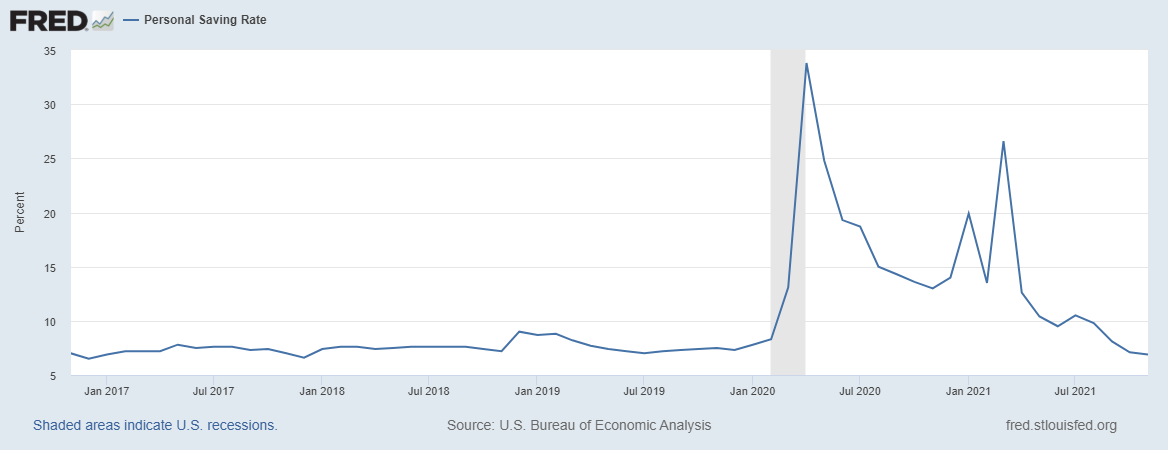

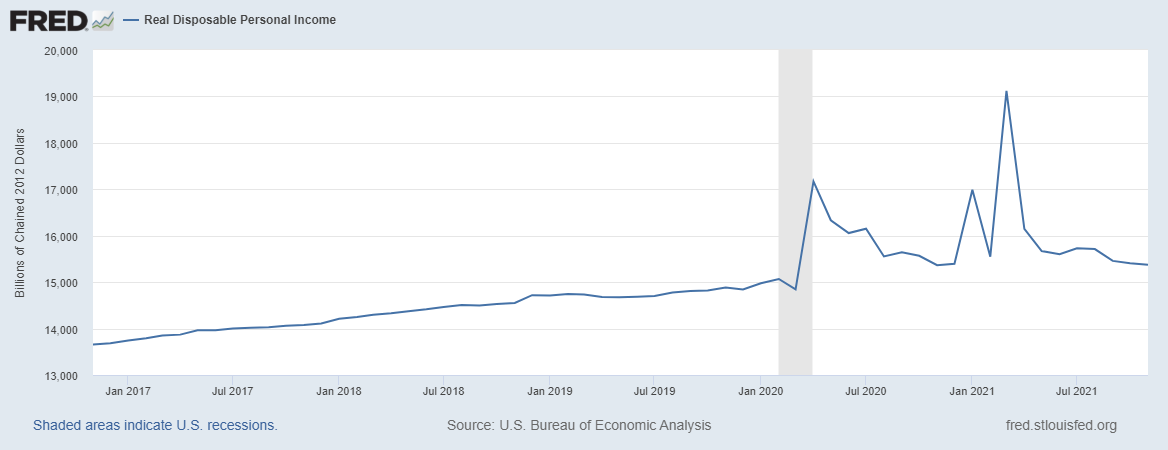

The private financial savings fee and disposable earnings are very wholesome to maintain the growth going! Regardless the catastrophe aid has light from the financial dialogue, each these ranges are good to visit as employment has picked up a great deal from the COVID-19 lows.

Nonetheless, similar to I'd an America is Again restoration mannequin on April 7, 2022, I’ve recession fashions and lift recession pink flags because the growth matures. Within the earlier month's jobs report, I raised one of many flags because the unemployment fee bought to 4% and also the 2-year yield was above 0.56%, which suggests the Fed fee hike is on.

As soon because the Fed raises charges, the second recession pink flag may be raised. My job is to point out you the progress from the financial growth, into the subsequent recession, and out – again and again. My fashions don't sleep! As soon as extra pink flags are elevated, I’ll go over each single one. In certain unspecified amount of time in the future eventually, I might be on recession watch, when sufficient pink flags are up. Nonetheless, we aren’t in that point but. Regardless that I now not say we’re early within the financial growth, we’re nonetheless on stable footing.

The publish Unemployment charges and mortgage charges each beneath 4% appeared first on HousingWire.