The 2022 Independent Business Survey from Advocates for Independent Business just came out. It's the 8th year from the survey, and the findings are essential for people trying to foster small businesses and native economies to digest. It requires the pulse of America's small and independent businesses, their triumphs, and just what they see because the barriers to their growth.

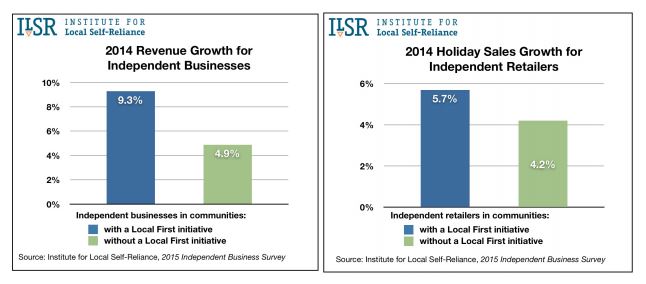

We've been taking concerning the improvement of small businesses in growth and hiring during the last 14 months – and just how they're making inroads against multinational and large chain competitors. The shop independent and small company and shop local movements are continuing to thrive, and people are beginning to exhibit a new desire to keep their cash within the cities, towns, and neighborhoods their current address.

But this survey sheds light on the difficulty on that road ahead, due to ingrained rules and processes that have a tendency to favor big companies within the small company sector.

So what did we learn?

- Small businesses in general pay better wages than big companies

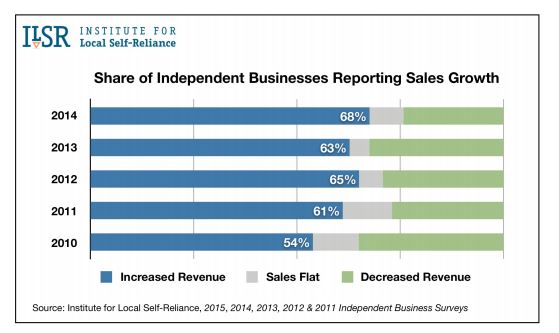

- On average smaller businesses are showing better gains and growth vs bigger companies

- Big corporations get more favorable pricing over small businesses

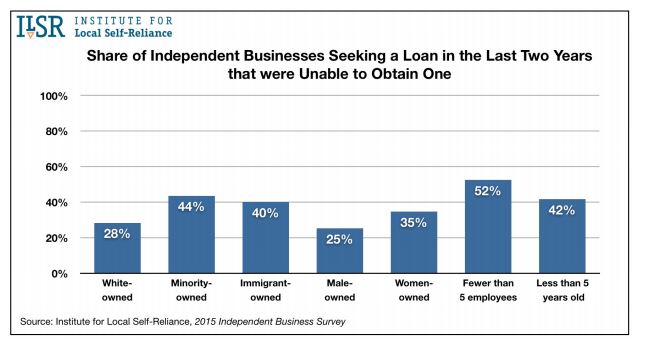

- Big corporations have renewed use of credit since 2010, smaller businesses don't

- Major online stores who don't need to collect florida sales tax are the biggest obstacle to small businesses growing

You can read the full report here.

Here's The Synopsis

PCV And Its Partners Are Working To alter This

All of those institutional barriers to small business success are now being tackled by PCV, the CDFI movement, and our partners advocating for local, state, and federal policy changes.

The “Donut Hole” Of Small company Lending

Since the end of the Recession, major banks have begun to loosen up their lending practices and use of credit – but mostly to corporations and major firms. Smaller businesses do not see the benefits of that, and therefore are using a hard time finding working capital. PCV and other CDFIs like us work in the middle of that donut hole, providing capital to established businesses beyond the startup phase, but who aren't big enough for that major banks to give loan to.

Impact Investing And Policy Changes

We realize that providing small businesses with working capital doesn't change the entire market landscape. To do that, our in-house InSight team is working on two fronts: to advocate for policies making it easier for small businesses to compete, find investment, and get their items to market, and measure the outcomes of those changes to show that small business investment and equitable pricing can be a boon towards the logistics, infrastructure, and investors and lenders.

Closing The Funding Gap

All of this jobs are to produce quality jobs in lower-income communities. It's to support and secure small businesses and native economies. It's to reduce income inequality, and make up a more equitable arena – specifically for women– or minority-owned small business. According to the “Kauffman Firm Survey,” men start firms with nearly twice the main city that ladies do. In addition, only 4.4 percent from the total dollar value of all small-business loans would go to women. And according to the the National Community Reinvestment Coalition, African-American businesses received 2.3 percent of Small Business Administration loans last year, down from 11 percent in 2008.

Employees of smaller businesses need their paychecks. Lower-income communities need their fair share of economic opportunity. And small business owners need support to be able to generate this kind of positive economic impact. Everyone knows the growing need of the person as well as the community, and that we have both a moral and an economic imperative to fuel social and economic mobility in this country. This survey sheds light around the 21st century problems that small businesses face. PCV provides a Twenty-first century means to fix that problem.

How Can I Become involved?

Help us really make a difference by recommending a small business to BusinessAdvising.org, or volunteer your expertise and join PCV's valued corps of small business advisors today!