I doubt you’ve noticed, but in the last decade, crowdfunding has become a genuine economic and cultural phenomenon. A study from 2022 found that crowdfunding had raised $35 billion — a figure which has undoubtedly grown significantly in the time since. Crowdfunding’s public profile appears to grow each day, with high-profile crowdfunding campaigns for medical emergencies, games, controversial political figures, and clickbait-ready projects such as the RompHim becoming viral stories unto themselves.

Crowdfunding’s effects have been felt everywhere, even though they've facilitated the raising of capital for businesses and causes that may otherwise struggle for funds, crowdfunding websites are also blamed for everything from accelerating political polarization towards the decline of IPOs.

What gets lost in the shuffle is that the term “crowdfunding” encompasses fundamentally disparate fundraising methods, grouping them underneath the same banner despite important practical and legal distinctions. I see a need to clarify things by drawing some distinctions between the various kinds of crowdfunding. I’ll be highlighting the implications of these differences for entrepreneurs and businesses seeking to tap the coffers from the Crowd. Different methods befit different ventures, and that we here at wouldn’t would like you to visit barking in the wrong crowdfunding tree, wasting precious time and energy.

Let’s zoom in on the categories into which these platforms fall: rewards, equity, debt, and donation crowdfunding.

Rewards-Based Crowdfunding

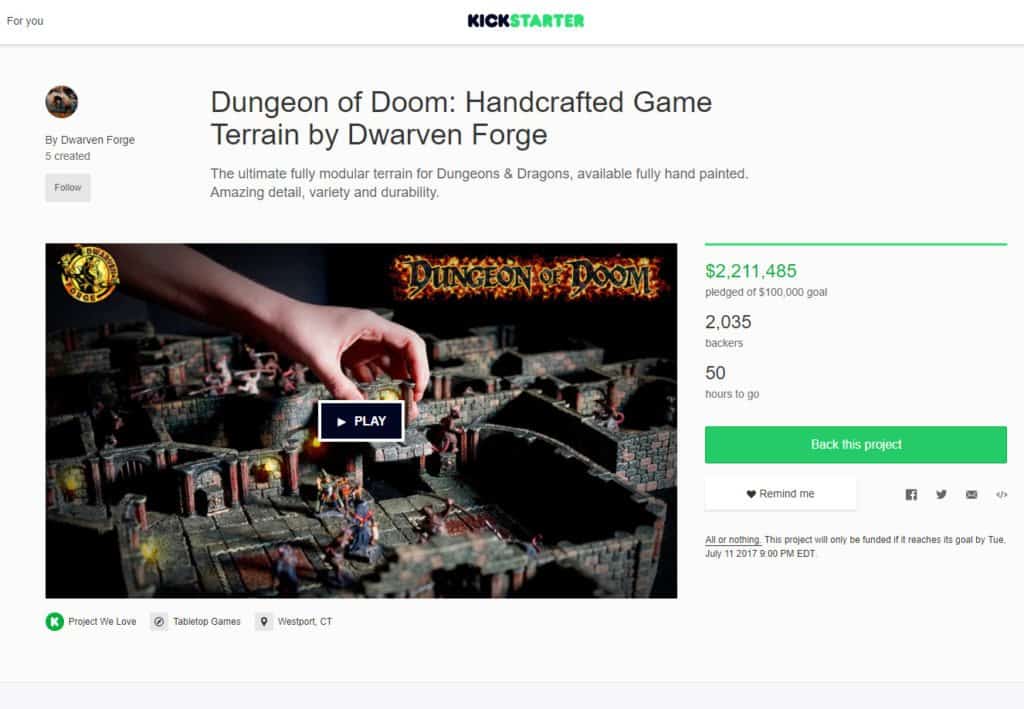

When the average person thinks about crowdfunding for business projects, they’re typically considering rewards-based crowdfunding platforms. That’s because crowdfunding has almost become synonymous with Kickstarter — probably the prototypical rewards crowdfunding platform — in the public mind. Rewards crowdfunding could be only the ticket for entrepreneurs and small businesses looking to raise money and stay from debt, especially if their venture requires the manufacture of tangible goods they can offer to backers as rewards.

Kickstarter is definitely an illustration of a pure rewards crowdfunding site. Kickstarter requires that your venture offer tangible rewards for your backers — it’s not optional. The very first rule on its Rules page states, “Projects must create something to see others.” In Kickstarter’s vision of rewards crowdfunding, the reward is an essential part from the project, not only a side benefit of supporting an offer. That’s why Kickstarter is an ideal crowdfunding platform for creative projects involving gadgets. All manner of tech projects, from 3D printers to Apple Watch chargers to hoverboards, have found fundraising success with Kickstarter.

Another genre of economic projects well-suited to rewards crowdfunding is tabletop gaming. In fact, board game campaigns have grown to be so popular the current renaissance in elaborate, art-heavy games is primarily attributable to Kickstarter.

Another big player in the rewards-based crowdfunding field is Indiegogo. Unlike Kickstarter, however, campaigners aren't required to provide rewards to backers — it’s merely a choice.

As it happens, Indiegogo is a superb place from which to originate a rewards crowdfunding campaign, especially in the realm of technology and style. If you’re thinking about launching a rewards crowdfunding project and you’ve got something cool to offer potential backers, Kickstarter and Indiegogo are the initial places I’d recommend looking. Given Kickstarter’s unmatched capability to draw site views and its second-to-none media outreach, this platform could be the recommended for any rewards campaign. However, Kickstarter is also relatively exclusive, and lots of projects have found crowdfunding success with Indiegogo following rejected by Kickstarter. This same openness and lack of vetting also mean that in backing an Indiegogo project, you take a higher risk of not receiving your promised reward than you need to do when supporting a Kickstarter project.

Indiegogo is a superb platform for film projects as well, being initially launched like a platform for indie filmmakers to raise money.

Platforms for example Patreon provide an alternate form of rewards crowdfunding: one based on recurring contributions from subscribers (referred to by Patreon as “patrons”). With Patreon, creators can raise money in excess of just a single product release or event. Patreon allows them to raise funds on an ongoing basis — either per-month or per-creation — from fans thinking about supporting them as creators.

Indiegogo also includes a recurring-funding platform (called InDemand). Unlike with Patreon, though, only projects which have already completed an effective initial crowdfunding campaign (though certainly not with Indiegogo) are eligible to use InDemand.

Rewards crowdfunding platforms typically keep about 5% of the items you raise as a platform fee, and also the payment processor will take an additional cut — generally around 2.9% + $0.30 per donation.

Now let’s take a look at some additional crowdfunding methods.

Equity Crowdfunding

The public might not be as acquainted with equity crowdfunding just like rewards- and donation-based crowdfunding, but that’s prone to change because the field expands. Equity crowdfunding bears a superficial resemblance to “traditional” crowdfunding, with the exception that rather than adding to a project in exchange for a prototype device as well as other reward, the backer becomes an investor who receives an ownership stake in the company under consideration. Essentially, equity crowdfunding involves investments, while rewards crowdfunding does not. Therefore, federal agencies such as the SEC regulate equity crowdfunding a lot more heavily than rewards crowdfunding.

For a long time, because of the inherently risky nature of these investments, there was no legal method to conduct an equity crowdfunding campaign. Enabling the existence of such campaigns was the main impetus for the passage from the JOBS Act. Conceived within the wake from the 2008 economic crisis (which dramatically decreased access to capital), the JOBS Act was signed into law in 2012. Amongst other things, the Act legalized the advertising and solicitation of securities, thus permitting companies to provide equity to investors in public places campaigns. Here’s where things obtain a little complicated.

The various provisions of the JOBS Act didn't enter into force simultaneously. Title II of the JOBS Act, which authorized equity crowdfunding using accredited investors, took effect in 2022. (‘Accredited investor’ is really a term talking about people who either possess a net worth of $1 million excluding the need for one’s primary residence or whose income has been $200K or even more over the last two years and who expects to make a minimum of that much in the current year. Basically, ‘accredited investor’ = rich person.) Titles III and IV from the Act, which authorized equity crowdfunding using non-accredited investors, took effect in 2022 and 2022. Which means accredited-investor-only equity crowdfunding has already established a bit more time to mature than equity crowdfunding for non-accredited investors.

Crowdfunder is really a representative example of an equity crowdfunding platform open to accredited investors only. Crowdfunder markets itself as an equity crowdfunding solution for “high-impact ventures” — i.e., businesses with the possibility of exponential growth. In other words, it’s not ideal for, say, a restaurant contemplating investing in new equipment. Since backers of an equity crowdfunding campaign have been in it to make money and never the promise of owning some new tech gizmo or tabletop roleplaying game, equity crowdfunding may be best suited to companies involved in less “sexy” fields than those that have a tendency to thrive with rewards crowdfunding campaigns.

Other players involved in equity crowdfunding for accredited investors include Fundable — which hosts both rewards and equity crowdfunding campaigns — and Wefunder. Fundable helps make the point that a rewards crowdfunding campaign can serve as a precursor to launching an equity crowdfunding campaign. Successful rewards campaigns may serve as proof of demand to woo investors to some subsequent equity campaign.

Equity crowdfunding for non-accredited investors is a much newer field, also it might take some time before all the nuances are fleshed out, and definitive statements can be created about the nature of the profession. However, companies for example Wefunder are now active within this realm, blazing a trail for other equity-crowdfunding-for-the-masses platforms to follow along with.

Debt Crowdfunding

Debt crowdfunding bears some similarities to equity crowdfunding. Both involve purchasing the safety of the company in question. The difference is, instead of receiving shares of the company in the hopes of having a slice of future profits, the investor gets paid back on the fixed schedule with interest. Basically, rather than borrowing from a bank, you’re borrowing from the crowd of investors.

“Crowdlending” is a great choice for a company with a precise need for money, a method for what to do with it, and a intend to pay it back. It doesn’t have quite the same novelty as rewards and equity crowdfunding, and it’s most likely not the best option for you personally if you’re the creator of some buzz-worthy gadget or even the CEO of some early-stage venture with the potential for exponential growth.

Not watch is going to be eager to undertake new debt, so it’s less attractive than other kinds of crowdfunding in that respect. However, strictly in terms of your likelihood of achieving funding success, debt crowdfunding is likely the safest bet of the three, as crowdlending sites don’t help make your funding based upon your cause’s virality.

Lending Club, Prosper, and Kiva U.S. are types of debt crowdfunding sites.

Donation Crowdfunding

Even if you’ve never heard the term “donation crowdfunding” before, you probably understand what it's. You’ve probably either heard about or donated to somebody’s GoFundMe campaign — perhaps to cover the medical expenses of a loved one. Maybe you’ve even needed to launch this type of campaign on your own in a time of hardship. Either way, the vast and ever-expanding ocean of unmet human needs in america (and elsewhere) should make sure that platforms such as GoFundMe and Mightycause will continue to develop in popularity.

So if donation-based crowdfunding is usually accustomed to raise funds to recuperate from a personal emergency or another charitable cause, why am I discussing donation crowdfunding within an article about business crowdfunding? Well, as it turns out, businesses can raise money on platforms such as GoFundMe. Go to GoFundMe’s Business page, and you’ll see numerous types of companies that have raised significant sums of money — often tens of thousands of dollars — on the platform.

One advantage of crowdfunding on sites such as GoFundMe and Mightycause is that these sites do not charge a platform fee. The only real fees deducted from what you raise are payment processing fees.

Of course, not only any company suits the GoFundMe type of crowdfunding. If your business has a heartwarming story behind its creation, is dedicated to helping the community or furthering social justice, is really a nonprofit organization, or else includes a compelling, empathy-based case to create itself, you may find funding success with GoFundMe. Take note of the nature from the business projects which have done well on GoFundMe and consider whether your project is appropriate for the platform. Otherwise, go with another form of crowdfunding.

With GoFundMe, you can offer rewards to backers in your campaign, technically making GoFundMe a platform for both donation and rewards crowdfunding. However, donors to GoFundMe campaigns are rarely motivated solely by the desire for a product or reward. A tech outfit seeking to fund its latest gadget release is, generally, more likely to find success with Kickstarter or Indiegogo than with GoFundMe.

Final Thoughts

Too a lot of the main city within our world is held under locksmith by big rent-seeking institutions — precisely where it does minimal good. Crowdfunding bypasses those stingy institutions by directly connecting businesses needing funds to people with money who are in position to gain something — whether physical, financial, or emotional — through said businesses’ success. I’ve provided a rundown of the four primary methods to conduct crowdfunding. Not one one of these methods can be said to become perfect for everyone. The easiest way I'm able to break it down is like this:

- Rewards-based crowdfunding is best for startups and businesses with something exciting to offer the public. Gadgets, games, movies, and dining experiences all qualify.

- Equity crowdfunding is best for companies with exponential growth potential but which might lack a singular product or experience that could generate viral enthusiasm.

- Debt crowdfunding is the best for startups and stable businesses that need cash for a defined purpose and that have a plan to pay back the borrowed funds.

- Donation crowdfunding is the best for nonprofits, businesses dedicated to a philanthropic cause, businesses struggling to recover from hardship, or other businesses that can appeal to donors’ sense of compassion.

Crowdfunding gives you the opportunity to raise funds without getting down in your knees and pleading with a impersonal bank. For your, we are able to be grateful. It’s still a relatively young industry, however, with new developments occurring in a rapid pace. Thank heavens you have to help you stay updated concerning the latest developments, eh?