The final 2 yrs happen to be an outrageous trip. We’ve had the sharpest and but additionally the shortest recession in background, record-low mortgage charges leading to report origination volumes, and report residence costs as housing demand far outstripped provide. Let's not disregard the substantial fiscal and financial coverage that supplied extraordinary ranges of assist for households, companies, and markets right here and overseas.

The most recent information in regards to the Omicron variant has numerous cautious about set up restoration that started within the second half of 2022 and blossomed in 2022 can proceed. Odds are this flip inside the pandemic will possible be merely a temporary setback. Public wellness officers notice that we've many extra instruments to cope with this newest – and sure not the final – problem.

However, whereas we view the tendencies described under since the most probably path for the financial system and mortgage market in 2022, these details highlights the improved degree of uncertainty we’ve all been residing using the previous few years. The pandemic, along with policymakers, proceed to possess the power to ship shocks through the system.

The primary takeaway from Mortgage Bankers Affiliation forecast is the fact that we have seen 2022 like a transition 12 months, transferring from a refinance sell to an order order market. Business veterans realize that previous related transitions have posed challenges because the industry activly works to match origination capacity to the newest degree of demand. A silver lining is the fact that we expect each 2022 and 2023 to become report years for buy originations.

In interested in the Twelve months forward, I’m going to border my feedback round 5 questions It's my job to listen to lenders.

How will the Federal Reserve answer financial developments in 2022, and what would be the influence on mortgage charges?

The Federal Reserve goals to fulfill three objectives: attain full employment, maintain inflation low and a secure monetary system. Extra particularly, which means focusing on an unemployment charge near 4%, inflation near 2%, and utilizing regulatory instruments to prevent unsound lending or different monetary imbalances.

In response to the pandemic, the Fed introduced short-term charges to zero whereas additionally more than doubling the length of their stability sheet, including trillions of dollars in Treasuries and MBS for their holdings.

When this text was revealed, the unemployment charge reaches 4.2%, inflation is above 6%, and every inventory market and housing industry values are elevated. MBA forecasts that the unemployment charge will dip under 4% subsequent 12 months, ending the Twelve months at 3.5%. Companies throughout the nation have more than 11 million job openings and therefore are elevating wages to try to fill them.

The one excellent totally to what extent people who’ve dropped out of the labor drive will be pulled again in as employers proceed to push-up their provides. Given that the decline in labor drive participation has been largest for older staff, a number of whom may have retired, at least briefly, it could take higher than a small elevate to attract them again into the employment market.

The enhancing job market is all towards the constructive. Nonetheless, inflation operating a lot more than the Fed's goal is troubling, as greater inflation expectations are becoming a part of shopper and enterprise decision-making. The Fed and different central banks around the world already are responding to this pattern using their phrases and are beginning to alter their actions. The Fed started to taper their asset purchases in November, and at their December assembly introduced they might double the pace of the taper from January, which means they might not be including to their MBS holdings after March.

Additionally on the December assembly, the median FOMC (Federal Open Market Committee) member indicated three charge hikes in 2022, though that's based mostly on a forecast of nonetheless robust progress and elevated inflation. Lenders ought to anticipate a quicker tempo of hikes over the following couple of years than was skilled following a 2009 recession.

A extra hawkish Fed, a strongly recovering economic climate, and huge federal finances deficits are prone to put upward strain on longer-term charges, along with mortgage charges. MBA forecasts that 30-year mortgage charges, averaging about 3.3% in the present day, will attain 4% through the tip of 2022.

Supply: FOMC Abstract of Financial Projections, December 2022

Will residence worth progress gradual in 2022? (What if it doesn't?)

Whereas the marketplace has struggled having a scarcity of stock in 2022 and builders have reported ongoing provide chain challenges, there are greater than 700,000 properties beneath development proper now, and a rising stock of latest properties available on the market. The stock of current properties stays fairly tight at less than 2.5 months, however the addition of recent properties towards the combo must lead to extra decisions for potential patrons in 2022, along with many who had hesitated to record their properties in 2022. This could create a rise within the variety of current properties listed.

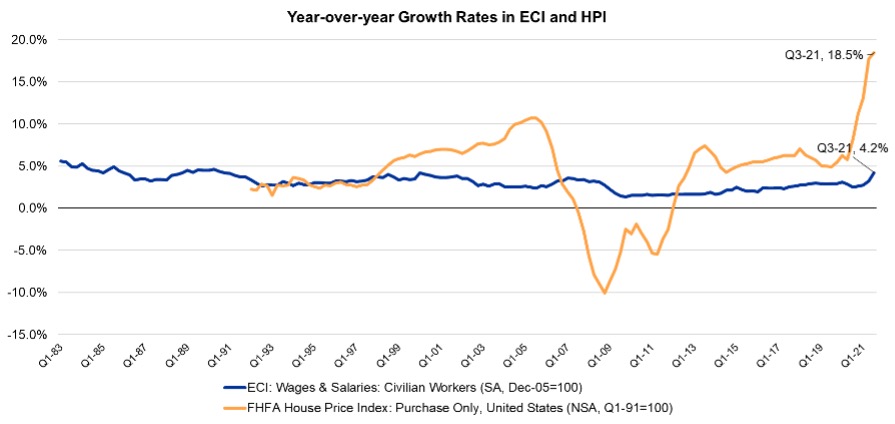

This extra stock is sorely wanted. Within the latest readings, residence costs nationally happen to be rising at about an 18% charge when compared with final 12 months, with double-digit progress in virtually each a part of the nation, and progress even sooner in aspects of the Mountain West. Per the chart under, this charge of progress is larger than 4 instances the tempo of earnings progress. That's clearly not sustainable, significantly for potential first-time homebuyers.

Whereas current householders can money of their fairness benefits and use that acquire towards a down cost for subsequent residence, first-time patrons are seeing their probability to buy lower, or at least are having to re-think the kinds and areas of properties they might be capable of afford.

The encouraging information? MBA's forecast for any rise in housing begins and residential gross sales, along with our expectation of considerably greater mortgage charges, must collectively lead to deceleration in home-price progress to round 5% in 2022. Realize that it's a deceleration – a slowing within the charge of progress, not a decline within the amount of residence costs.

May residence costs really decline subsequent 12 months? Sure, when we have been to get a spike in mortgage charges or another shock that leads to a rapid stop by demand proper when the brand new provide arrives. Nonetheless, I’m frankly much less fearful about this situation, and additional fearful that for different causes, maybe ongoing supply-chain constraints impacting homebuilders, the additional provide doesn’t arrive. In that case, there might be actually an opportunity that residence costs may proceed to rise at unsustainable ranges, rising the risk the market might run right into a wall in some unspecified time in the near future subsequent Twelve months regarding buy demand, exhibiting up as a pointy drop in buy purposes.

Sources: BLS and FHFA

Sources: BLS and FHFA

Will we transfer right into a purchase order market subsequent 12 months?

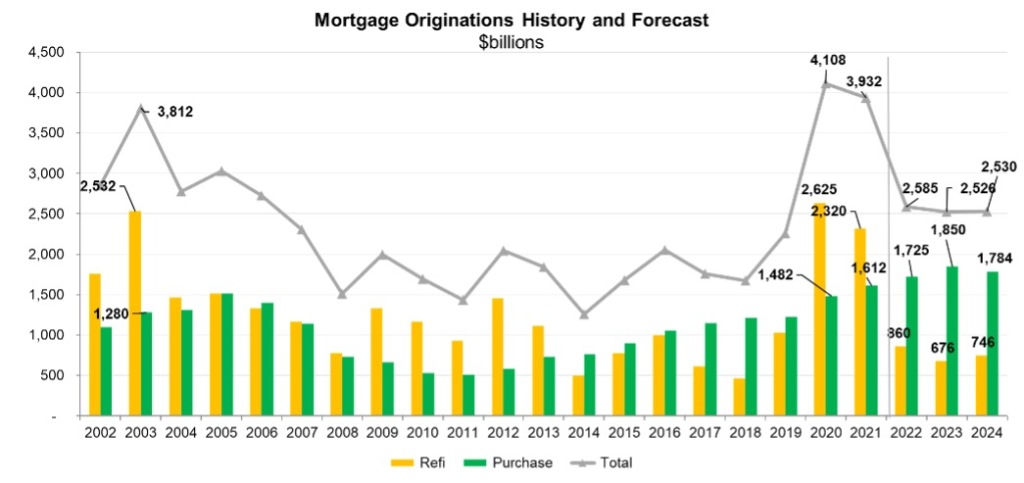

Refinance quantity might have totaled greater than $5 trillion between 2022 and 2022, roughly half of mortgage debt excellent, and representing 15 million refinance loans. After all, that implies that 15 million householders now have remarkably low mortgage charges. Will those that didn’t refinance when charges have been under 3% be used with doing this if charges rise to 4%? Whereas there shall be debtors who shall be taken with cash-out refinances because of the speedy progress in residence fairness the previous couple of years, MBA is forecasting a pointy stop by whole refinance quantity in 2022 and expects that quantity to stay decrease in 2023.

Nonetheless, whereas whole origination quantity is forecast to drop from $3.9 trillion in 2022 to $2.6 trillion in 2022, maybe the larger shift may be the transition from the refi to a purchase order market. Buy loans current completely different challenges and alternatives for lenders, each in respect to the combo of enterprise and also the necessity to help keep robust relationships with actual property brokers, builders, yet others within the housing industry.

Given our outlook for residence product sales and housing begins outlined earlier, MBA forecasts a study Twelve months for buy quantity in 2022, pushed by millennials reaching peak first-time homebuyer age, a robust job market, and continued increases in residence costs.

Supply: MBA Forecast

Supply: MBA Forecast

Will there be a increase in foreclosures subsequent 12 months since the remaining debtors in forbearance exit?

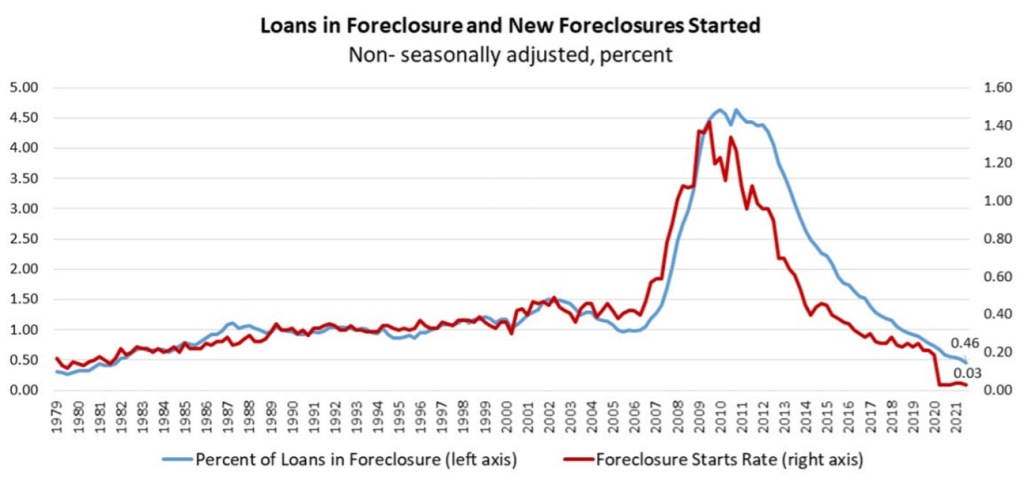

When the unemployment charge spiked to virtually 15% final 12 months because the financial system was shut down to protect in opposition to the main wave of COVID-19, policymakers and servicers moved extremely rapidly to supply forbearance to thousands of householders. In June 2022, greater than 8.5% of all householders having a mortgage will be in forbearance. Whereas mortgage delinquency charges spiked in live show using the leap within the unemployment charge, these forbearance plans and foreclosures moratoria enabled householders influenced by the pandemic to climate the storm.

The foreclosures moratoria have now been lifted, and many owners are reaching the expiration of the forbearance phrases. Most debtors exiting forbearance thus far have been capable of resume making their unique funds, whereas some debtors have entered modifications, needing lowered funds for a time. MBA's Weekly Forbearance and Name Quantity Survey and new Month-to-month Mortgage Monitoring Survey observe the efficiency of those exercises, that have been constructive to this point.

Previous to the pandemic, foreclosures ranges have been extraordinarily low. In 2022, using the moratoria in position, they dropped even decrease, with foreclosures begins and foreclosures stock charges at or close to all-time lows. These ranges are certain to include some degree, however given the success of forbearance exits to this point, we anticipate the degrees to remain extraordinarily lower in 2022.

Supply: MBA's Nationwide Delinquency Survey

Supply: MBA's Nationwide Delinquency Survey

With the anticipated decline in origination quantity subsequent Twelve months, will margins tighten (additional)?

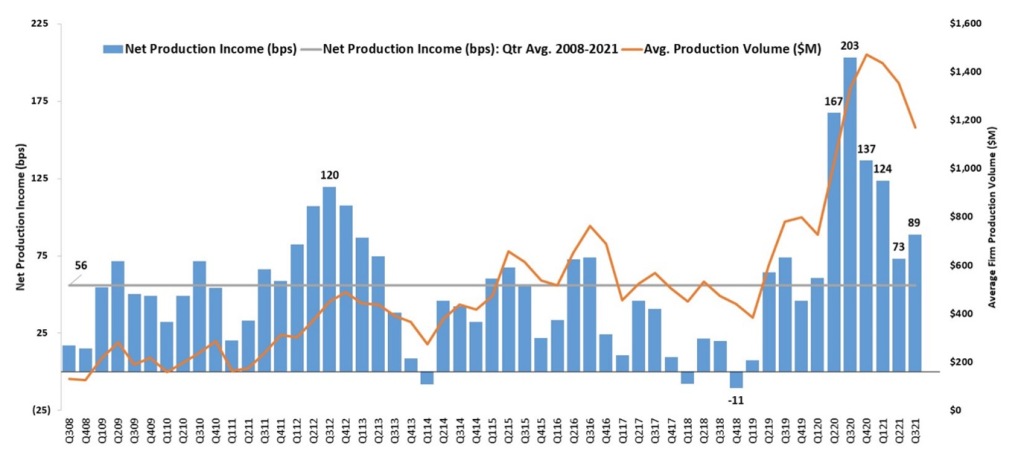

2022 was a report origination quantity 12 months along with a worthwhile Twelve months for mortgage originators, as proven through the triple-digit margins in MBA's Quarterly Efficiency Report information. As had been typical in prior refinance waves, when the industry is working at or past capability, margins enhance, however, this time, bills happen to be elevated as lenders gone to live in distant work and staffing shortages abounded throughout many roles.

In 2022, as refinance quantity crested and began to wane, margins have trended downwards as nicely. The upper personnel and operational prices adopted to fulfill the report quantity stay, nevertheless the industry presently has some additional capability, and that’s exhibiting up as a stop by margin. It is crucial spotlight the third quarter of 2022 margin of 89 foundation factors remains above the historic common of 56 foundation factors, when information going again to 2008.

After all, buy volumes show massive seasonal swings, main margins inside the fourth and first quarters of each and every 12 months to be a great deal decrease than the others in the middle of the 12 months.

Whereas MBA doesn’t forecast industry-level margins, it’s cheap you may anticipate extra tightening inside the 12 months forward given our forecast of a transfer to some purchase order market along with a pointy stop by refinances. We’ve already seen tightening for an excellent larger extent in third-party channels, as lenders lean extra closely there, maybe to make up for misplaced quantity through the retail channel. If we glance again to 2022 or early 2022, there’s sometimes a time of below-average profitability because the industry right-sizes following a refinance wave.

Supply: MBA's Quarterly Efficiency Report

Supply: MBA's Quarterly Efficiency Report

2022 ought to be a Twelve months of upper mortgage charges, fewer refinances, extra buy quantity, a extra sustainable charge of home-price progress, a heightened, however nonetheless low amount of foreclosures, and tighter margins for originators. This a area of the cycle is at all times a problem for lenders, however mortgage bankers have been by way of this sooner than.

This column doesn’t essentially mirror the opinion of HousingWire's editorial division and it is house owners.

To contact the writer of the story:

Mike Fratantoni at mfratantoni@mba.org.

To contact the editor liable for this story:

Sarah Wheeler at swheeler@housingwire.com

The submit Mike Fratantoni on MBA’s 2022 mortgage market forecast appeared first on HousingWire.